Easily Organize, Claim and Renew Insurance!

Making Insurance Simple

Explore the Turtlemint Blog to get answers to many questions related to Health, Life, Motor Insurance and much more!

Health

We have decoded health insurance just for you

-

Revolutionising Health Insurance – Cashless Hospital Treatment Everywhere

When you choose a health insurance plan, it is often suggested that you choose an insurer that allows you the…

Ankita Sejpal| -

Best Health Insurance Policy in India 2024

Health insurance is a must-have product in today’s time because of the rise in the number of lifestyle diseases and…

Ankita Sejpal| -

How Senior Citizens Can Save Tax With Medical Bills Under Section 80D?

Table of Contents Healthcare expenses during old age can put a significant burden on finances. Investing in a comprehensive health…

Ankita Sejpal| -

Network vs Non-network Hospitals – Key Difference Between Network and Non Network Hospitals

Table of Contents Hospitalisation often triggers worry. Separation from home, medical procedures, and uncertainties about recovery can induce anxiety in…

Rupanjali Mitra Basu| -

Health Insurance Plans Covering Pre-existing Diseases (PED) from Day 1

Recent reports reveal that more than 101 million people in India suffer from diabetes1, especially people over the age of…

Rupanjali Mitra Basu| -

No Claim Bonus – Different Types of NCB in Health Insurance

The discovery of numerous diseases, high medical inflation of 14%, and unhealthy lifestyles are some of the reasons that make…

Rupanjali Mitra Basu| -

Waiting Period – Types of Waiting Periods in Health Insurance

Health insurance is the key to financial well-being and peace of mind. Amid rising health concerns, pandemics, poor lifestyle choices,…

Rupanjali Mitra Basu|

Life

Know all about the right life insurance cover

-

Top Life Insurance Companies in India (Updated List 2024)

Table of Contents Introduction to Life Insurance Life insurance is a mutual agreement between an insurance company and a policyholder….

Ankita Sejpal| -

What is Mobile Insurance? Compare Mobile Phone Insurance – A Detailed Guide, 2024

Mobiles have become the part and parcel of the modern generation. It is no longer just a means to talk…

Ankita Sejpal| -

Difference Between Annuity & Life Insurance

Life is full of surprises. Understanding and planning before any unforeseen events give you the benefit of financial stability. Knowing…

Rupanjali Mitra Basu| -

Employees’ State Insurance Scheme – All you need to know about ESIS

Table of Contents What is the ESIS? What is the Employees’ State Insurance Corporation? Employees’ State Insurance Corporation Composition Eligibility…

Ankita Sejpal| -

YSR Pension Kanuka Eligibility Criteria, Benefits & Types

Table of Contents What is YSR Pension Kanuka? Y.S.Jagan Mohan Reddy, the Chief Minister of Andhra Pradesh announced YSR Kanuka…

Ankita Sejpal| -

Deferred Annuity: Meaning, Benefits, Types & How It Works

Financial planning is important in all phases of life. But planning for retirement is vital to secure social status and…

Ankita Sejpal| -

Assignment vs Nomination in Life Insurance

Table of Content: Difference between nomination and assignment What is nomination in life insurance? Types of nominees in life insurance…

Swapnil G|

General Insurance

Get to know about various types of general insurance

-

Top 5 Financial Tips you must follow on the auspicious occasion of Diwali in 2022

The Diwali season is here and most households are fervently engaged in the Diwali cleaning procedure, a tradition that is…

Rupanjali Mitra Basu| -

What Is General Provident Fund (GPF): Know How it works & Benefits

The provident funds allow residents to save funds for retirement with monthly deposits and calculated interest. There are three provident…

Swapnil G| -

Types of General Insurances in India General Insurance Guide

General insurance policies are those that cover non-life risks, i.e. risks not associated with life. They cover various types of…

Sidharth Hampanavar| -

Why an e-Insurance Account is a Must in Today’s Age?

The wave of technological development has been sweeping the nation far and wide. Fat wallets have slimmed down due to…

Ankita Sejpal| -

e-Insurance Plans – Benefits & Process of Opening e-Insurance Account

The digital age is moving at a tremendous speed and almost everything is now available online. When it comes to…

Sidharth Hampanavar| -

Complete Guide on Credit Insurance – Coverage, Claims & Exclusions

Businesses and companies work on credit. The raw materials that they buy and the finished goods which are sold are…

Ankita Sejpal| -

Renters Insurance: Everything You Need to Know (Detailed Guide)

A home insurance policy is said to be important to protect against the financial loss suffered if the house is…

Rupanjali Mitra Basu|

Car

Know everything about car insurance before buying

-

What is Insured Declared Value (IDV) and How to USE IDV Calculator?

Table of Contents What is IDV Full Form? What is IDV in Insurance? Calculation of Insured Declared Value (IDV) Depreciation…

Rupanjali Mitra Basu| -

What is Commercial Vehicle Insurance? Benefits, Coverage and Full Policy List

Every vehicle plying on the Indian road needs to be mandatorily insured. If you are running a business, Insurance is…

Ankita Sejpal| -

6 Tips On How College Kids Can Lower Their Car Insurance

As a college student, you are always looking for options to save money. If you are a kid with a…

Ankita Sejpal| -

Everything First-Time Car Buyers Must Know About Car Insurance

Your first car always brings a sense of euphoria, it brings a sense of freedom and independence. It also means…

Rupanjali Mitra Basu| -

5 Easy Ways to Increase the Cost-Effectiveness of your Car Insurance

A car has become an indispensable part of the modern-day lifestyle. It facilitates easy commute, is cost-effective and convenient. In…

Sidharth Hampanavar| -

5 Best Add-on Car Insurance Covers in 2024

Comprehensive car insurance plans allow all-around protection for your beloved car. These plans cover the mandatory third-party liability and also…

Rupanjali Mitra Basu| -

Everything You Need To Know About Electric Car Insurance

Flaunting an electric vehicle has become a new trend all over the globe. Speaking of India, they are gaining a…

Ankita Sejpal|

Bike

Know how to protect your most prized possession

-

Two-Wheeler Renewal is Not only Easy but is also the Right Thing to Do!

Two-wheelers are the most convenient modes of transport, especially in a country like India where traffic jams are the norm…

Rupanjali Mitra Basu| -

What is IDV in Bike Insurance & Factors Affecting your Bike Insurance IDV?

What’s Inside What is IDV in Bike Insurance? You must have been interested in learning more about IDV and how…

Rupanjali Mitra Basu| -

How to Re-Register a Vehicle in India?

Registration is a process of registering the vehicle in some specific person’s name. This is done at the time of…

Ankita Sejpal| -

Complete Information on How to Transfer Two-Wheeler Ownership

Buying a second-hand bike is quite common in today’s age. A second-hand bike is more affordable and it also fulfils…

Ankita Sejpal| -

What is Personal Accident cover in Bike Insurance Plans?

When you buy a bike, you need to buy a valid insurance policy on the bike as well. The Motor…

Rupanjali Mitra Basu| -

What Is Insurance all about?

Insurance is an ancient concept. The first form of insurance emerged to limit the loss of goods during inland transit…

Rupanjali Mitra Basu| -

Difference Between Comprehensive & Third-Party Insurance

Traffic rules and regulations are laid down in the Motor Vehicles Act, 1988. The Act specifies the rules for driving…

Rupanjali Mitra Basu|

Company updates

We are growing! Be a part of our growth journey!

-

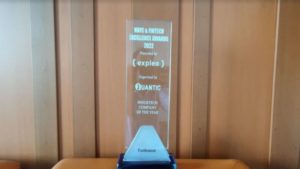

Turtlemint wins “InsurTech Company of the year” at the NBFC & Fintech Excellence Awards 2022 by Quantic India

We have done it again! From being recognised for our tech enablement in multiple forums, Turtlemint has now bagged the…

Sidharth Hampanavar| -

Turtlemint wins the “Best Fintech Startup” by Entrepreneur India at the Start up Awards 2022

The latest feather in the cap for Turtlemint is the “Best Fintech Startup” award by Entrepreneur India at the Start…

Sidharth Hampanavar| -

Turtlemint wins “The Best Digitally-Enabled Enterprise” award hosted by BW Businessworld

The eminent jury comprising industry veterans and seasoned BFSI stakeholders have selected and conferred Turtlemint with “The Best Digitally-Enabled Enterprise.”…

Sidharth Hampanavar| -

Turtlemint Recognized for Building “10X Culture that Employees Love!

Turtlemint, an insurtech start-up, which has pioneered the online-offline model and created the largest insurance advisor network in India, has…

Sidharth Hampanavar| -

Do Multiple Life Insurance Policies Make Sense?

Did you know that you can buy more than one life insurance policy? Even if you did, how many of…

Rupanjali Mitra Basu| -

Upskilling the Aspiring Micro-Entrepreneurs in India

While the beginning of this decade has been dominated by ramifications of the COVID-19 pandemic, its middle and end will…

Sidharth Hampanavar| -

‘Necessity is the Mother of all Invention’ – The Advisor Story

COVID-19 has been tough on all of us. It upended the way we work and live and has, in some…

Sidharth Hampanavar|