Life insurance is the insurance of human life. The insurance covers the risk of premature death as well as the risk of living too long. Life insurance policies allow coverage for a specified tenure. If, during the term of the plan, the insured dies, the policy pays a death benefit. Moreover, many life insurance plans also pay a maturity benefit when the chosen term comes to an end.

Term Life Insurance Premium Calculator

Term insurance premium calculator is an excellent online tool that helps term insurance buyers. On using this calculator, you can get an estimate of the premium that needs to be paid for a certain plan. It assists the buyer in not only calculating the term insurance premium but also comparing and determining a range of term insurance plans provided by all the renowned term insurance firms online.

By using the term insurance premium calculator, you can create a detailed and comprehensive comparison between the distinct term insurance plans based on a range of factors including profession, gender, age, medical records, etc. In addition, you can get an idea of the premium of the term insurance plan change on altering the variables. All in all, term insurance premium calculator educates and keeps you well-grounded with respect to insurance plans to help you make better decisions.

Human Life Value Calculator

To obtain the ideal/ suitable figure for your life cover, you can try the Human Life Value Calculator. As the name suggests, a human life value calculator helps individuals calculate the total monetary/economic value of one’s life. This value is calculated based on savings, income, and liabilities. To be more precise, the value indicates the decrease in income and increase in liabilities that a family needs to face after the sudden demise of the primary earning member.

Thus, a human life value calculator helps you to determine or fix an amount that would be useful and fit as a life cover for your family members. When you check in with an HLV calculator, this amount takes care of all your family needs in case of your premature death. Based on factors like your profile, liabilities, savings, and income, the calculator analyses and displays the best life cover for you.

Importance of Life Insurance

Life insurance policies help individuals create a financial net in case of their premature death. Since the policy promises a death benefit, you can be assured that your family will get a lump sum benefit in your absence through your life insurance policy. Besides providing financial security, there are life insurance policies which also help in creating savings. There are savings oriented life insurance plans which can be selected to accumulate an investment corpus. These plans are offered both as guaranteed plans as well as market-linked plans. While guaranteed plans provide guaranteed returns, market-linked plans provide returns as per the performance of the capital market. Thus, life insurance plans help you fulfil your security as well as investment needs.

History of life insurance in India

Life insurance was introduced in India in the year 1818 when Oriental Life Insurance Company was formed in Kolkata. The company, however, failed in the year 1834. In 1870 the British Insurance Act was passed and the Bombay Mutual, Empire of India and Oriental Insurance companies were formed. There were many foreign insurance companies too which gave very tough competition to Indian insurance companies. In the year 1938, the Insurance Act was passed which contained the rules and regulations for conducting insurance business in India. The Insurance Amendment Act was passed in the year 1950. There were many insurance companies operating in the market in the 1950s. This prompted the Government to nationalize the business of insurance. The life insurance business was, therefore, nationalized and the Life Insurance Corporation of India (LICI) was established in 1956. LIC was formed by absorbing 154 Indian insurance companies, 75 provident societies and 16 non-Indian insurance companies. In the year 1993, the Indian Government created the Malhotra Committee with a view to reforming the life insurance sector. As per the recommendations of the committee, the Insurance Regulatory and Development Authority of India (IRDAI) was created in the year 1999. Moreover, the committee also proposed opening up of the life insurance segment to private companies. As a result, from the year 2000, private companies were allowed to start their life insurance business. Today, there have been many changes in the insurance sector and there are more than two dozen life insurers competing in the market.

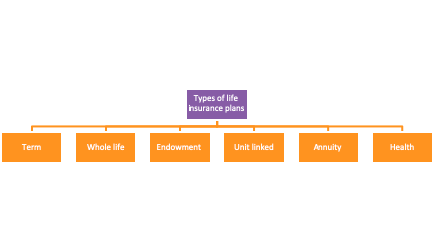

Types of life insurance plans

Life insurance plans are available in many different kinds. The types of life insurance plans can be seen in the following chart –

Each of these types of plans is further subdivided into various types. So, let’s understand each type of plan as well as its sub-variants –

- Term Insurance Plans

Term insurance plans are pure protection plans. These plans usually cover death during the term of the policy. If the insured dies during the policy tenure, the sum assured is paid. Term plans have very low premiums which allow individuals to choose an optimal level of coverage for financial security. Term plans are further categorised as the following types –

- Level term plans where the sum assured remains constant throughout the term of the policy

- Increasing term plans where the sum assured increases by a fixed rate every year

- Decreasing term plans where the sum assured decreases by a fixed rate every year

- Return of premium plans where the premiums are refunded back if the insured survives till maturity of the plan.

- Whole life insurance Plans

Whole life plans are like term insurance plans which pay a death benefit if the insured dies. However, unlike term plans, whole life plans have no fixed tenure. These plans continue to the insured attains 100 years of age. Whenever the insured dies before attaining 100 years, the death benefit is paid.

- Endowment Insurance Plans

Endowment insurance plans are savings oriented life insurance plans. These plans promise guaranteed returns either on the death of the insured or on the maturity of the plan. Endowment plans can also participate in bonus declarations which help in increasing the corpus being accumulated under the plan. Endowment plans can be subdivided into the following types –

- Money-back insurance plans wherein the sum assured is paid in instalments at periodic intervals over the term of the policy.

- Savings plans where the sum assured, bonus and any other additions offered under the plan are paid either on death during the term or when the plan matures

- Child plans which are created specifically for securing the financial future of a child. These plans have an inbuilt premium waiver benefit which waives the premiums on the death of the parent. The plan, however, continues and pays the maturity benefit when the term comes to an end.

- Unit linked insurance plans (ULIPs)

ULIPs are market-linked insurance plans. The premiums paid for the plan are invested in market-linked funds. You can choose the investment fund as per your risk appetite. The fund, thereafter, grows as per the performance of the market and yields returns. ULIPs also provide flexible options of partial withdrawals, switching, top-ups, etc.

- Health insurance Plans

Life insurance companies also offer specialised health insurance plans which cover specific illnesses. If the insured suffers from the covered illness during the policy tenure, the plan pays a lump sum benefit. This benefit helps the policyholder meet the heavy expenses related to medical treatments.

- Annuity Plans

Annuity plans are also called pension plans. These plans aim to create a corpus for retirement from which the policyholder can receive regular incomes. Annuity plans come in two variants which are as follows –

- Deferred annuity plans where the policyholder can choose a policy tenure and pay premiums over the chosen tenure. The premiums would be accumulated into a retirement corpus from which annuity pay-outs would be made till the lifetime of the annuitant.

- Immediate annuity plans wherein the annuity pay-outs start immediately after the plan is bought.

Riders available in life insurance policies

Riders are additional coverage options which can be selected with the base policy by paying an additional premium. There are different types of riders which are offered by life insurance companies. Each rider promises additional coverage benefit. The available riders include the following –

- Accidental death and disablement benefit rider – Under this rider, the policy pays an additional sum assured if the insured dies in an accident or becomes disabled.

- Premium waiver rider – Under premium waiver rider the premiums are waived off if the policyholder dies but the insured is alive or in case of disablement.

- Critical illness rider – This rider covers specified critical illnesses. If the insured suffers from any of the covered illness during the policy tenure, a lump sum benefit is paid.

- Hospital cash benefit rider – Under this rider a daily cash benefit is paid if the insured is hospitalised for 24 hours or more.

Difference between health plans offered by life insurers and general insurers

Life and general insurance companies both offer health insurance plans. However, there are significant differences between the plans offered by the two. These differences include the following –

| Health plans by life insurers | Health plans by general insurers |

| The plans cover specific illnesses and ailments. The plans can cover critical illnesses, major ailments like heart related ailments or cancer or cover personal accidents. | The plans cover all types of illnesses, ailments, injuries, etc. which result in hospitalisation. The plans can be indemnity hospitalisation plans, critical illness plans, personal accident plans, diabetes-specific plans, etc. |

| A fixed lump sum benefit is paid in case of a claim | These plans are mostly indemnity plans which pay the actual medical costs incurred on treatments. However, there are fixed benefit health plans too which pay a fixed lump sum benefit |

| The term of the plans can range from 5 years to up to 30 years | These plans are offered for one year only. However, you can buy a continuous coverage for two or three years by paying the aggregate premium at once |

| These plans usually cover only individuals | These plans can be taken to cover all the members of the family |

Life insurance premium and coverage

When buying a life insurance policy, you should always choose a coverage amount which would be sufficient for your financial needs. The choice of coverage of a life insurance policy should, ideally, depend on the following parameters –

- A number of dependents – the higher the number of dependents that you have, the higher should be the sum assured.

- Disposable income – disposable income determines the affordability of the premium that you can pay. If your income is high, opt for a higher sum assured for better coverage.

- City of residence – if you live in a metropolitan city, the lifestyle expenses would be higher. A high sum assured is needed in such cases.

- Current lifestyle – your sum assured should be sufficient to enable your family to enjoy your current lifestyle in your absence.

- Assets and liabilities – your assets and liabilities also determine the coverage that you need. If you have considerable assets and limited liabilities, a smaller sum assured would be sufficient. Alternatively, if you have higher liabilities and limited assets to take care of such liabilities, a higher sum assured would be needed.

Based on the above-mentioned factors and your financial goal, you should calculate the ideal amount of sum assured for your life insurance plans. When it comes to premiums, the factors are different. Premium depends on the mortality risk that you present to the company. The following factors affect the premium rates of your life insurance policy –

- Age – the older you are the higher would be the mortality risk. That is why premiums are higher at older ages and increases with an increase in the age of the insured

- Gender – female lives are considered to have a lower mortality rate than males. Females are, therefore, charged lower premiums

- Medical history – if you have an adverse medical history of ailments or diseases, your mortality risk would increase. This would, subsequently, increase the premium amount

- Coverage term – the longer the term the lower would be the premium charged and vice-versa

- Occupation – if you are employed in dangerous occupations like mining, aviation, armed forces, etc., the premiums would be higher

Tax implications of life insurance policies

Life insurance policies are quite popular for their tax-saving nature. They promise dual tax benefits on the premiums paid as well as the benefits earned. Let’s understand the different tax implications of life insurance plans.

- Tax benefit under Section 80C Section 80C allows life insurance premiums paid to be claimed as a deduction. You can claim a maximum premium of INR 1.5 lakhs as a deduction from your taxable income. However, to become eligible for the deduction, the premium paid should not be more than 10% of the sum assured of the policy if the policy has been issued on or after 1st April 2012. However, if the policy has been issued on or before 31st March 2012, the premium paid can be up to 20% of the sum assured. If the premium is more than 10% or 20% of the sum assured, the deduction can be claimed on the premium amount equivalent to 10%/20% of the sum assured. The excess would be taxable. For instance, if the sum assured of the policy is INR 5 lakhs, the premium should be less than INR 50,000 to be eligible as a deduction. If the premium is INR 60,000, the deduction can be claimed only on INR 50,000 and the remaining premium of INR 10,000 would become taxable.

- Tax benefit under Section 80CCC This section provides tax benefits on the premiums paid for annuity plans. If you buy an annuity policy and pay the premiums for the same, the premium paid would be allowed as a deduction under Section 80CCC. The limit of deduction is INR 1.5 lakhs which includes Section 80C. For instance, if you buy a unit-linked plan and an annuity plan and pay premiums of INR 1 lakh each for both, the deduction would be available only up to INR 1.5 lakhs. The remaining INR 50,000 would be taxable.

- Tax benefit under Section 80D Section 80D allows a deduction for the premiums paid towards a health insurance policy. So, if you buy a health insurance plan, accidental death benefit rider, critical illness rider or hospital cash benefit rider, the premium paid for the same would be allowed as a deduction under Section 80D. The limit of deduction is INR 25,000. The limit increases to INR 50,000 if you are a senior citizen. Moreover, if you pay additional premiums for your parents who are senior citizens, you can claim an additional deduction of up to INR 50,000.

- Tax benefit under Section 10 (10A) Under deferred annuity plans, 1/3rd of the accumulated corpus can be withdrawn on maturity. The amount withdrawn is called commuted pension. Commuted pension is allowed as a tax-free benefit under Section 10 (10A). There is no limit on the deduction allowed as long as the amount is 1/3rd of the total corpus.

- Tax benefit under Section 10 (10D) The maturity benefit, death benefit and surrender benefit received under life insurance policies are all allowed as tax-free benefits under Section 10 (10D). There is no limit on the benefits which can be claimed as a tax-free benefit. The entire amount of benefit would be allowed tax exemption.

Life insurance underwriting –

Underwriting of life insurance policies means assessment of risk. After you make a proposal for buying a life insurance plan, the company’s underwriters assess the risk which the company would be taking if the policy is issued. Underwriting is done on three parameters which include the following –

- Medical underwriting – under this aspect your mortality risk is assessed. The underwriter checks your medical history and ascertain whether you have normal risk or higher risk of death.

- Financial underwriting – under this aspect your financial capacity is judged. The underwriter checks whether the sum assured that you have chosen is justified depending on your financial net worth and if the premiums of the policy would be affordable for you to pay or not.

- Moral hazard – the possibility of moral hazard is always checked by the underwriter. Moral hazard means the risk of the insurance company being defrauded or cheated by the proposer. If you opt for a very high sum assured or insure a non-earning member of the family, the underwriter might detect a case of moral hazard. If the moral hazard is detected, the proposal is rejected and the policy is not issued.

Only after the policy is successfully underwritten by the insurance company would it be issued.

List of life insurance companies in India

Here is the complete list of life insurers which are operating in India with the details of their stakeholders

| Serial number | Name of the company |

| 1 | Life Insurance Corporation of India |

| 2 | HDFC Life Insurance Company Limited |

| 3 | Axis Max Life Insurance Company Limited |

| 4 | ICICI Prudential Life Insurance Company Limited |

| 5 | Kotak Mahindra Life Insurance Company Limited |

| 6 | Aditya Birla SunLife Insurance Company Limited |

| 7 | TATA AIA Life Insurance Company Limited |

| 8 | SBI Life Insurance Company Limited |

| 9 | Exide Life Insurance Company Limited |

| 10 | Bajaj Allianz Life Insurance Company Limited |

| 11 | PNB MetLife India Insurance Company Limited |

| 12 | Reliance Nippon Life Insurance Company Limited |

| 13 | Aviva Life Insurance Company Limited |

| 14 | Sahara India Life Insurance Company Limited |

| 15 | Shriram Life Insurance Company Limited |

| 16 | Bharti AXA Life Insurance Company Limited |

| 17 | Future Generali India Life Insurance Company Limited |

| 18 | IDBI Federal Life Insurance Company Limited |

| 19 | Canara HSBC OBC Life Insurance Company Limited |

| 20 | Aegon Life Insurance Company Limited |

| 21 | DHFL Pramerica Life Insurance Company Limited |

| 22 | Star Union Dai-ichi Life Insurance Company Limited |

| 23 | IndiaFirst Life Insurance Company Limited |

| 24 | Edelweiss Tokio Life Insurance Company Limited |

| 25 | Ageas Federal Life Insurance |

Claim settlement ratio of life insurance companies

Every financial year life insurance companies face claims under the policies that they have sold. Against the total claims raised on the company in a financial year, the number of claims that the company settles determines its Claim Settlement Ratio (CSR). CSR is, therefore, calculated as the ratio of claims settled by the company against the total claims made on it. The higher the ratio the better it is for customers as a high ratio indicates that the company has settled most of its claims. A high CSR is, therefore, recommended and a symbol of trust in the company.

CSR of life insurance companies for the financial year 2020-21

| Name of the company | Claim Settlement Ratio |

| Life Insurance Corporation of India | 98.62% |

| HDFC Life Insurance Company Limited | 98.01% |

| Axis Max Life Insurance Company Limited | 99.65% |

| ICICI Prudential Life Insurance Company Limited | 97.9% |

| Kotak Mahindra Life Insurance Company Limited | 98.5% |

| Aditya Birla SunLife Insurance Company Limited | 98.04% |

| TATA AIA Life Insurance Company Limited | 99.13% |

| SBI Life Insurance Company Limited | 93.09% |

| Exide Life Insurance Company Limited | 98.54% |

| Bajaj Allianz Life Insurance Company Limited | 98.48% |

| PNB MetLife India Insurance Company Limited | 98.17% |

| Reliance Nippon Life Insurance Company Limited | 98.49% |

| Aviva Life Insurance Company Limited | 98.01% |

| Sahara India Life Insurance Company Limited | 97.18% |

| Shriram Life Insurance Company Limited | 95.12% |

| Bharti AXA Life Insurance Company Limited | 99.05% |

| Future Generali India Life Insurance Company Limited | 94.86% |

| Canara HSBC OBC Life Insurance Company Limited | 97.1% |

| Aegon Life Insurance Company Limited | 99.25% |

| Star Union Dai-ichi Life Insurance Company Limited | 95.96% |

| IndiaFirst Life Insurance Company Limited | 96.81% |

| Edelweiss Tokio Life Insurance Company Limited | 97.01% |

Top #5 tips to choose the best life insurance company

There are 24 life insurance companies in the market and each company offers something better than the other. This makes it difficult to choose the best life insurer. However, here are five tips which you should consider when choosing the best life insurance company for your insurance needs –

- The range of plans offered

All life insurance plans approved by the IRDAI and hence are all good. However, you need to choose a plan which offers you the best features that suit your requirements. The company should offer a range of life insurance plans so that you can find the best plan which would suit your coverage requirements.

- The coverage benefits offered

When comparing the plans of different insurance companies, their relative coverage benefits should be compared. The company which offers a wider scope of coverage would be a better choice as it would ensure that you get better benefits from your insurance policy.

- The premium charged

The premium charged by the insurance company should also be taken into consideration. The company offering the best coverage features at the lowest premium would be the best insurance company to buy your policy from.

- The company’s reputation

The company which enjoys the best reputation in the market should be the chosen life insurance company.

- The Claim Settlement Ratio (CSR)

Life insurance companies should be judged based on their claim settlement ratios. Companies having high claim settlement ratios consistently over the year would be the best companies. A high ratio would ensure a higher probability of settlement of your life insurance claims and so it should be considered.

FAQ’s

Some of the most dependable life insurers in India are:

- HDFC Life Insurance Company

- ICICI Prudential Life Insurance Company

- Life Insurance Corporation (LIC) India Company

You can make a claim by informing the insurance company about the same. the company would require you to fill out a claim form and submit the relevant documents. Once you do the needful, the claim would be settled. You can also raise your claim through Turtlemint which is an easier alternative. All you would have to do would be to inform Turtlemint’s claim helpline department at 1800 266 0101 or write a mail to claims@turtlemint.com. After you have intimated the claim, Turtlemint’s claim department would help you get the claims settled quickly and easily.

A claim occurs when the insured dies during the term of the plan. In such a case, the insurance company pays the death benefit. Moreover, if the policy has a maturity benefit and the insured survives the term of the plan, the policy would pay a maturity benefit too.

Yes, you can buy any number of policies from multiple life insurance companies without any problems.

Life insurance policies can be bought from the authorised agents of the company. You can fix an appointment with an advisor, understand the plan benefits and then buy the policy. You can also visit the nearest branch of the chosen life insurance company and buy the policy from there. Another alternative way to buy life insurance plans is through online mode. Life insurance policies are increasingly being sold online and you can buy a plan easily. Turtlemint is one such online platform which allows you to buy the required life insurance policies of leading companies. You can compare and then choose the best life insurance suiting your coverage requirement from Turtlemint’s website.

Yes, you can buy as many life insurance policies that you want. There is no limitation to the number of policies which you can buy.