-

5 Things To Keep In Mind While Selecting A Travel Insurance

Travelling is something that excites us all, visiting new places, meeting new people, etc. It is interesting, by all means….

-

What Is Sum Insured In Health Insurance

An insurance policy consists of a number of clauses that you must be aware of. However, if you are new…

-

Are There Any Add-Ons Possible With A Third-Party Bike Insurance Plan?

Just like toppings on a pizza that comes at an additional cost enhance the taste, add-ons on an insurance policy…

-

Important Things Every Smoker Should Know About Life Insurance

Smoking or consumption of tobacco can affect the cost of your life insurance and harm your health. If you are…

-

Did you know these Taxation facts about your Insurance policies?

Insurance is popular not only for its benefits but also for its tax-saving nature. Whether you buy life insurance or…

-

Family Floater vs Individual Health Insurance

When it comes to health insurance policies, there are two variants that you can choose from – individual policy and…

-

What does your two-wheeler say about you?

How many times have you seen a Hayabusa stuck in traffic at a busy junction and wondered, “He must be…

-

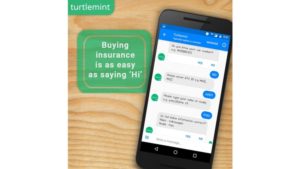

Introducing the Turtlemint Chatbot- India’s first and only chatbot for buying insurance

Need to buy insurance but just can’t find the time? Read on, as now it’s as easy as saying ‘Hi’….