The Unit Trust of India is one of the oldest Asset Management Companies in India which was established in the year 1964. UTI provides different types of mutual fund schemes for investors. The company not only offers mutual funds but other services too like portfolio management services, venture funds, retirement solutions, etc. The company is one of the leading Asset Management Companies in the market with a presence across 150 branches in India and having investor accounts of more than 1 crore individuals.

Table of Contents

Besides the different types of mutual fund schemes offered, UTI also offers a unit-linked insurance plan that combines the benefit of insurance cover and investment returns under one.

Let’s understand the plan in detail –

What is a unit-linked insurance plan?

A unit-linked insurance plan is a plan which provides insurance coverage as well as market-linked returns. The investments made under a unit-linked plan are invested in market securities. Thereafter, as the securities perform, the investment grows. There is also an insurance cover that pays a lump sum benefit if the investor dies during the term of the plan. Thus, unit-linked insurance plans give you the benefit of mutual funds like investments and also provide financial security through insurance coverage in case of untimely demise.

UTI Unit Linked Insurance Plan:

UTI launched a unit-linked insurance plan on 1st October 1971. Thereafter, the fund has attracted many investors, and the Assets under Management as of 31st July 2019 stand at INR 4182.03 crores. Here are the salient features of the plan –

- The plan comes in two variants of Direct and Regular. Direct plans can be bought directly from UTI while Regular plans can be bought through mutual fund brokers.

- The fund invests in debt and equity instruments in a ratio of 60%:40%. Since debt exposure is high, returns are more stable. While equity investments promise attractive returns, debt investments bring stability to the fund portfolio.

- No pre-entrance medical check-ups are required to buy the plan.

- You can invest the premium in a lump sum or through SIPs.

- There is no entry load on your investments. This means that the entire premium paid is utilized for investment promising higher returns.

- You can opt for a Systematic Transfer Investment Plan (STRIP) and choose to invest in UTI ULIP systematically. Under the STRIP option, the investment would be done from another plan to UTI ULIP at regular intervals.

The investment objective of the UTI Unit-Linked Insurance Plan:

The scheme aims to maximize wealth over a long-term period by investing in equity and debt instruments. It also aims to provide life insurance coverage to investors during the plan tenure so that they can secure themselves financially.

Plan parameters of the UTI Unit-Linked Insurance Plan:

Here are some of the important parameters of the plan

| Who can buy it? | Resident individuals and NRIs. The plan can also be bought in the name of the spouse or dependent children |

| Duration of the plan | 10 years or 15 years |

| Entry age | Plan term 10 years – 12 to 55.5 years

Plan term 15 years – 12 to 50.5 years |

| Minimum investment into the scheme | INR 15,000 |

| Maximum investment into the scheme | INR 15 lakhs |

| Life insurance cover | INR 15 lakhs |

| Life insurance cover for non-earning females | Up to INR 5 lakhs |

| Exit load | 2% if withdrawal is done before the completion of the tenure |

| Total Expense Ratio | Direct plan – 1.17%

Regular plan – 1.81% |

| Benchmark index | CRISIL Short-Term Debt Hybrid 60+40 Fund Index |

Plan benefits of the UTI Unit-Linked Insurance Plan:

The plan offers the following benefits –

- Life insurance cover:

A life insurance cover of up to INR 15 lakhs is available under the plan. You can choose to avail the cover in the following two options –

- Declining Term Insurance Cover wherein the coverage amount would reduce every year

- Fixed Term Cover wherein the coverage amount would remain the same throughout the term of the plan.

In case of premature death of the insured, the applicable coverage amount would be paid.

There is also an inbuilt personal accident insurance cover under the plan. The cover is allowed for up to INR 50,000. If the insured dies in an accident, the additional coverage of INR 50,000 would be paid along with the sum assured.

- Bonus

Even though the investments earn attractive market-linked returns, UTI’s unit-linked insurance plan also offers guaranteed bonus to investors. Bonus is paid once the duration of the scheme comes to an end. The bonus payable under the 10-year scheme is 5% and for the 15-year scheme is 7.5%. Moreover, if you continue your investments in the scheme even after the duration is over, you will get a 0.5% additional bonus on the target amount. This is called a maturity bonus and the bonus is paid for each additional year after maturity till you remain invested in the scheme.

- Maturity benefit

Once the chosen duration of the plan comes to an end, you can withdraw the accumulated corpus in full. There would be no exit load charged on such withdrawal. Once a withdrawal is done, the plan will be terminated.

- Premature withdrawals

You can withdraw from the scheme completely or partially at any time that you want before the chosen term comes to an end. However, for each premature withdrawal, an exit load of 2% would be applicable.

The investment portfolio of the scheme:

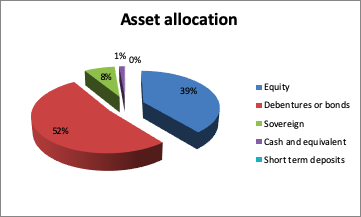

As mentioned earlier, UTI Unit Linked Insurance Plan invests in equity and debt in the ratio of 40:60. The exact asset allocation of the fund is as follows –

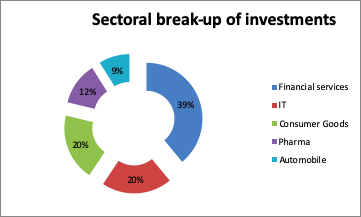

The top 5 sectors into which the fund invests are as follows –

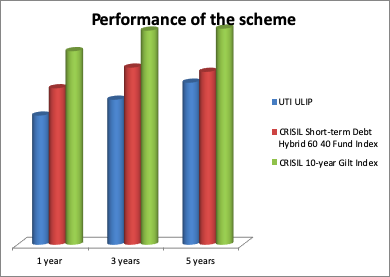

The performance of the fund, in terms of absolute returns, as compared to its benchmark index and CRISIL 10-year Gilt Index over different periods is as follows –

NAV of the UTI Unit Linked Insurance Plan scheme:

The current Net Asset Value of UTI ULIP stands as follows –

| Type of scheme | Net Asset Value as of 30th August 2019 |

| Regular | INR 23.8954 |

| Direct | INR 24.6981 |

(Source:https://www.moneycontrol.com/mutual-funds/nav/uti-unit-linked-insurance-plan/MUT018 and https://www.moneycontrol.com/mutual-funds/nav/uti-unit-linked-insurance-plan-ulip-direct-plan/MUT663)

Why buy UTI ULIP?

- You get a free insurance cover to provide financial security for your family in case of your untimely demise.

- There is an added accidental cover which pays an enhanced benefit in case of accidental death.

You can enjoy attractive returns at low volatility because of the composition of the fund and its asset allocation.

- You can avail easy liquidity by withdrawing from the scheme whenever you want.

- The premium that you pay would be eligible for tax deductions under Section 80C of the Income Tax Act. You can claim deductions of up to INR 1.5 lakhs through investing in the scheme.

- The plan can be easily bought since there are no medical check-ups that you need to undergo to buy the policy.

UTI ULIP, therefore, gives you many benefits including insurance. You can trust the expertise of the oldest Asset Management Company (UTI) to provide you with the best returns on your investments. So, invest in UTI’s unit-linked plan and enjoy the benefit of investment as well as insurance.

Read more:

FAQs

1. What is the mode of investing in the scheme?

You can invest annually, half-yearly, or through SIPs.

2. What is the tax implication on capital gains earned from the scheme?

When the plan matures after the selected tenure, the capital gains that you earn will be subject to taxation. Since the plan invests predominantly in debt instruments, the capital gains would be taxed at @20% with indexation benefit.

3. What is the tax implication of the death benefit?

The death benefit would be a tax-free income in the hands of the nominee under Section 10 (10D).

4. Can investments of more than INR 15 lakhs be made towards the scheme?

Yes, you can invest more than INR 15 lakhs but the target amount of investment and the insurance coverage would be available only up to INR 15 lakhs.