Are you looking for the best health insurance company in India? If yes, then you are at right place.

Today’s age is the age of technology where medical treatments have become advanced and cutting edge. There are treatments for most chronic illnesses too and so life expectancy has increased. However, though medicine has advanced, it has also become expensive. Affording quality healthcare has become financially distressing in modern times.

Moreover, as life expectancy has increased, so has the incidence of illnesses. You, therefore, need a health insurance plan to cover the rising costs of medicine and protect yourself financially in a medical emergency.

In India, there are more than two dozen health insurance companies which offer a range of health insurance plans for your needs. Some companies also feature in the top 10 health insurance companies from which you can choose the best health insurance policy.

So, let’s have a look at the top 10 health insurance companies in India 2024.

Table of Contents

- Health Insurance Companies – Overview

- Standalone Health Insurance Companies vs General Insurance Companies

- Why Compare Health Insurance Companies?

- List of best health insurance companies in India

- Best Health Insurance Companies in India: Key Features

- Top 10 Health Insurance Companies, 2024 Based on CSR

- How to choose a health insurance plan?

- Types of health insurance plans in India

- Types of Fixed benefit health insurance policies in India

Health Insurance Companies – Overview

Health insurance is one of the most vital insurance policies that you need in your lifetime. It offers financial coverage for all your healthcare needs and those of your loved ones as well. Considering the high demand for mediclaim policies, several health insurance companies operate in India. There are nearly 31 health insurers in India, of which 26 are General Insurers and 5 Stand-Alone Health Insurance Companies.

This blog highlights some of the best health insurance companies in India to make your search easier.

Difference Between Standalone Health Insurance Companies and General Insurance Companies

Standalone health insurance companies offer customers specific products, including accident, health, and travel coverage. General insurance companies however have a wider array of product offerings comprising home, motor, and business insurance.

This means that standalone health insurance companies would generally work better if you are only looking for health insurance since it is their specialized product.

Why Compare Health Insurance Companies?

With tons of offerings before you by numerous health insurers in India, it helps to draw a fair comparison between them all to ensure that you get the best deal at the time of buying medical insurance.

Make sure that you do a thorough research of the product offerings of all the health insurance companies and also read carefully through the premium rates, coverage, as well as exclusions of each. This would give you a better idea of which insurer best meets your healthcare requirements and also fits well within your budget.

List of best health insurance companies in India

With several options available in the market, it helps to do your homework well before proceeding with buying health insurance for you and your loved ones. The table below highlights the top 25 health insurance companies in India for your easy reference:

| Name of the Company |

Solvency Ratio (2022-23) |

Incurred Claim Ratio (2022-23) |

Cashless Hospitals Network (2022-23) |

| Bajaj Allianz |

3.68 |

74.27 |

11,000+ |

| Future Generali |

1.86 |

79.18 |

8,430+ |

| HDFC Ergo |

1.75 |

79.04 |

12,000+ |

| IFFCO Tokio |

1.73 |

111.18 |

7,000+ |

| Liberty |

2.34 |

74.17 |

5,000+ |

| Navi |

2.69 |

59.28 |

12,000+ |

| Royal Sundaram |

2.17 |

83.36 |

10,000+ |

| TATA AIG |

1.97 |

78.33 |

10,000+ |

| Zuno |

1.72 |

89.59 |

10,000+ |

| New India Assurance |

1.82 |

103.33 |

2,055+ |

| United India Insurance |

0.15 |

89.57 |

6,500+ |

| Care Health Insurance |

1.83 |

53.82 |

22,900+ |

| Niva Bupa |

1.79 |

54.05 |

10,000+ |

| Star Health |

2.03 |

65 |

14,000+ |

| Acko |

4.26 |

83.88 |

14,300+ |

| Cholamandalam |

2.07 |

67.88 |

10,000+ |

| Go Digit |

1.96 |

71.87 |

16,400+ |

| ICICI Lombard |

2.51 |

77.33 |

7,500+ |

| Kotak Mahindra |

2.95 |

56.01 |

7,700+ |

| Magma |

2.19 |

72.10 |

7,200+ |

| Raheja |

1.96 |

138.67 |

5,000+ |

| SBI |

1.86 |

73.92 |

6,000+ |

| Universal Sompo |

1.73 |

82.84 |

4,000+ |

| National Insurance |

0.16 |

102.35 |

3,000+ |

| Oriental Insurance |

-0.63 |

130.09 |

3,500+ |

Best Health Insurance Companies in India: Key Features

Let us now take a quick look at some of the best health insurers listed in the table above in detail. Below is a brief description of the top 10 health insurance companies in India and the key features they offer:

1. Bajaj Allianz

One of the top health insurers in India, Bajaj Allianz Health Insurance is a part of Bajaj Allianz General Insurance Company – a joint venture by Allianz SE and Bajaj Finserv Limited – set up in 2001. The company offers a wide range of health insurance plans to customers, meeting varied requirements and budgets.

Key features:

- Coverage of maternity expenses

- Hospitalization cost covered

- Critical illness insurance plans

- Annual or bi-annual health check-ups covered

- Daycare treatments coverage

2. Future Generali

Started as a joint venture between the Italian Generali group and the Future Group of Industries, Future Generali Health Insurance has earned a reputed name for itself in the health insurance sector since its operations. The company offers comprehensive health insurance plans designed to meet all types of healthcare needs of its customers.

Key features:

- Tax deductions offered on premiums paid

- Prompt claim settlement

- Cost of prescription medicines covered

- Coverage for ambulance

- Coverage for online doctor consultation in case of severe injury or illness

3. HDFC Ergo

Germany-based ERGO International AG and HDFC Ltd. started this joint venture in 2002 to offer health insurance plans to all segments of society at competitive rates. The company provides financial coverage to individuals, families, and women for all their healthcare treatments and requirements.

Key features:

- An initial waiting period of 30 days

- Comprehensive coverage provided

- Coverage for critical illnesses

- High CSR

- Cashless treatments offered at network hospitals

4. IFFCO Tokio

An offering of IFFCO-Tokio General Insurance Company Limited, IFFCO Tokio Health Insurance was set up in 2000 as a joint venture between IFFCO and Tokio Marine Group, a Japan-based company. IFFCO Tokio Health Insurance provides various health insurance plans for individuals and families alike.

Key features:

- In-patient hospitalization covered

- Emergency assistance provided

- Lifetime renewability option

- AYUSH treatments covered

- Tax benefits offered

5. Liberty

The health division of Liberty General Insurance Ltd., Liberty Health Insurance offers a wide range of health insurance plans that are affordable and also offer cashless treatment options to customers. The company was established as a joint venture between DP Jindal Group, the US-based Liberty Mutual Insurance Group, and Enam Securities in 2013.

Key features:

- The sum insured ranges from INR 3 lakhs to INR 15 lakhs

- Global coverage provided under specific plans

- Daily hospital cash allowance offered

- Domiciliary treatment options

- Plans available for both individuals and families

6. Navi

A wholly-owned subsidiary of Navi Technologies, Navi General Insurance came into existence in 2017 and has been serving customers with a variety of insurance products and services ever since. The company operates in health, motor, property, gadget, and commercial insurance services at reasonably priced premium rates.

Key features:

- Cashless claim approval within 20 minutes!

- No-claim bonus offered for every claim-free fiscal year

- Lumpsum offered to the policyholder on the first diagnosis

- Coverage for surgeries

- Easy EMI options for premium payment

7. Royal Sundaram

Started by Sundaram Finance as a joint venture with some Indian shareholders in the year 2000, Royal Sundaram Health Insurance is an offering by Royal Sundaram General Insurance Co. Ltd. It is also the first provider of general insurance in the Indian private sector.

Key features:

- Expenses for hospitalization covered

- Vaccinations for animal bites

- Ambulance coverage

- Daycare treatments offered

- Domiciliary hospitalization covered

8. TATA AIG

The company offers a variety of health insurance plans to help people meet a wide range of medical emergencies. The plans are customized to meet different types of healthcare requirements of customers and are affordably priced too.

Key features:

- Maternity cover available

- Cumulative bonus provided for claim-free years

- Tax benefits offered on paid premiums

- AYUSH benefits offered

- Accidental death benefit offered in lumpsum

9. Zuno

Offering specialized health insurance plans for families, Zuno Health Insurance is one of the renowned names in the health insurance market. Its family plans are designed to offer comprehensive coverage to all family members based on the floater sum insured.

Key features:

- Eligibility for plans from 90 days onwards up to 65 years

- Easy to afford premiums

- Comprehensive health coverage

- Pre- and post-hospitalization expenses covered

- Sum insured from 1 lakh to 5 crore

10. New India Assurance

Completely owned by the Indian government, New India Assurance offers insurance solutions in at least 27 countries and has established itself as a market leader in the non-life insurance segment in India. New India Assurance is the only insurance provider regarded as the direct insurer in India.

Key features:

- Cataract treatment covered

- Coverage for ICU charges

- Daily hospital cash

- Accident cover

- Coverage from birth

Top 10 Health Insurance Companies in India 2024 Based on Claim Settlement Ratio

We listed above the best health insurance companies in India that offer affordable health plans to individuals and families. Let us now take a quick look at the top 10 health insurers in the country in 2024 based on their CSR. A good CSR ratio defines a company’s credibility in the market to settle claims instantly and is one of the important factors taken into consideration by customers while selecting a health insurer for their needs.

| Name of the Health Insurer |

CSR for FY 2021-22 |

| Care Health |

100% |

| Niva Bupa |

99.9% |

| Navi General |

99.9% |

| ManipalCigna |

99.9% |

| Aditya Birla |

99.4% |

| Star Health |

99.06% |

| Reliance Health |

98.65% |

| HDFC Ergo |

98.49% |

| Liberty Health |

97.30% |

| Zuno Health |

97.26% |

How to choose a health insurance plan?

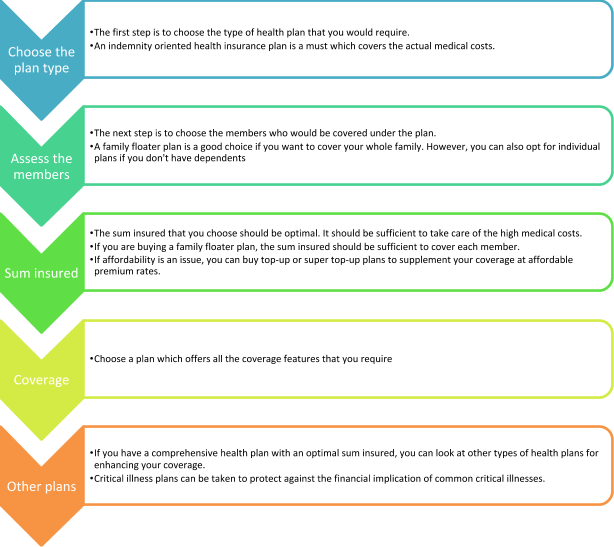

Among the different varieties of health insurance policies available in the market, choosing the most suitable health plan might prove to be a challenge. So, here are some pointers on how you can choose the best health insurance plan for yourself and your family.

Types of health insurance plans in India

These health insurance companies in India offer different types of health insurance plans. Let’s find out the types of plans available and what exactly such plans cover –

Indemnity Health Insurance Plans: This type of plan pays only for the expenses incurred during hospitalization.

- Individual health insurance policies –

Individual health insurance plans cover a single person. The plan has a single coverage amount or sum insured which can be utilised by the insured individual for his medical costs.

- Family floater health insurance plans –

These health plans cover the entire family under one sum insured. Family members include you, your spouse, dependent children and dependent parents. Moreover, there are family floater plans which allow coverage for your extended family members too like your uncle, aunt, siblings, etc.Under family floater health insurance plans, a single health insurance plan is issued and the policy covers all family members. Every covered member would be covered for the full sum insured.However, if one member of the family makes a claim, the sum insured would be reduced. Subsequent claims in the same policy year would then be covered up to the reduced sum insured. Family floater health insurance plans have lower premiums compared to individual health insurance plans for different family members.As such, family floater health insurance plans are quite popular and the top ten health insurance companies offer one or more family floater health plans with comprehensive coverage.

- Senior citizen health insurance plans –

Normal health insurance plans might have a limit on the entry age. These plans usually allow the maximum entry age to 60 or 65 years. For older individuals, there are senior citizen health insurance plans.Senior Citizen health insurance plans are specially designed for providing coverage individuals who are senior citizens, i.e. aged 61 years and above. Senior citizen plans can be taken to cover a single individual or both the husband and wife on a family floater basis. The sum insured under these plans is limited and the premiums are affordable so that older individuals can afford coverage.Moreover, the coverage benefit under senior citizen health insurance plans are also designed keeping in mind the health needs of senior citizens.

- Top-up and super top-up health insurance policies –

Top-up and super top-up health insurance plans act as complementary health insurance plans to increase your existing health insurance coverage. Under these health plans, there is a fixed deductible limit and a sum insured.You can choose both the limit and the coverage amount. These plans cover the actual medical costs that you incur provided that the costs exceed the selected deductible. If the claim is below the deductible limit, nothing would be paid. However, if the claim exceeds the deductible limit, the excess would be covered by top-up and super top-up health plans.Thus, if you have an existing health insurance plan, the coverage of the plan can be chosen as a deductible under a top-up or super top-up plan. Claims up to the deductible would be paid by your existing health insurance plan.Excess, if any, would be paid by the top-up or super top-up health insurance plans. Thus, you can get coverage for high sum insured levels at affordable premiums because top-up and super top-up plans have low premiums.

Moreover, if you choose top-up and super top-up plans offered by the 10 best health insurance companies, you would also get a comprehensive scope of coverage which covers a range of medical expenses which you might incur.

- Disease specific health insurance policies –

Under disease specific health insurance policies, one or more specific illnesses are covered. Such illnesses are not considered pre-existing illnesses and you get coverage within a short time after buying the policy.Thereafter, if you suffer any medical complications due to the covered illnesses, the plans would pay the medical costs that you incur. Common illness or disease specific health insurance plans include diabetes care plans, cardiac care plans, dengue plans, etc.

Types of Fixed benefit health insurance policies in India

These types of plans pay a fixed amount of money on diagnosis of the listed ailment, irrespective of the amount spent on hospitalization.

Under fixed benefit health insurance plans, the following types of plans can be found –

- Critical illness health plan –

Critical illness health insurance plans cover specified critical illnesses and medical procedures. If during the term of the policy, you are diagnosed with any of the covered illness or you undergo any of the covered medical procedures, the plan pays the entire coverage amount in a lump sum. Common critical illnesses which are covered include cancer, first heart attack, open chest CABG, Coma, kidney failure where regular dialysis is required, etc. When you choose critical illness plans offered by the top ten health insurance companies, you can get coverage against an exhaustive list of critical illnesses.

- Hospital cash plan –

Hospital cash plan is also a fixed benefit health plan. Under this plan, if you are hospitalised for 24 hours or more, a fixed lump sum benefit would be paid daily for each day of hospitalisation. Moreover, there is a fixed daily benefit if you are admitted to the ICU. In case of ICU admission, the hospital daily benefit payable usually doubles. The fixed daily benefit is paid up to a specified number of days per instance of claim.

- Personal accident plans –

Under personal accident plans, accidental death and disablements are covered. If, in an accident, you suffer accidental death or total/partial permanent disablement, a lump sum benefit would be paid. The benefit depends on the contingency suffered. In case of accidental death and accidental total and permanent disability, 100% of the sum insured is paid. For partial disabilities, 25% to 75% of the sum insured is paid depending on the disability suffered. Personal accident plans also allow optional coverage benefits for loss of job, funeral expenses, fractures, children’s education fund, etc.

A list of the best health insurance companies in India are mentioned on this page from where you can take your pick of a health insurance product from the above-mentioned insurers and be assured that you would get the best health insurance coverage.

Turtlemint provides you with a comprehensive overview of all the health insurance plans offered by the top 10 health insurance companies so that you can enjoy comprehensive coverage with some of the best features and the premiums would also be affordable.

Moreover, with the wide network of tied-up hospitals which then top 10 health insurance companies have, your claims would be settled on a cashless basis and that too within the shortest possible time. So, choose these top 10 health insurance companies from Turtlemint and enjoy good health insurance coverage.

Also Read:

Found this post informational?

Browse Turtlemint Blogs to read interesting posts related to Health Insurance, Car Insurance, Bike Insurance, and Life Insurance. You can visit Turtlemint to Buy Insurance Online.

FAQ’s

Generally, it is recommended that you buy health insurance for yourself and your loved ones in your 20s since you are young and working and can easily pay off the premiums during your working years.

Section 80D of the Income Tax Act offers tax deductions on premiums payable for the health insurance plan to customers up to a max limit of Rs. 25,000 during a fiscal year.

The maximum limit set for mediclaim policies in India is up to Rs. 25,000 for self, spouse, parents, and dependent children. For senior citizens (60 years and older), the limit is up to Rs. 50,000.

The Pradhan Mantri Jan Arogya Yojana (PMJAY), also known as the Ayushman Bharat Yojana, is an annual health insurance plan of 5 lakhs per family, launched by PM Modi.

A 5 lakh health insurance plan in India is one of the highly preferred health insurance options chosen by a majority of customers for individual and family health plans.

Some of the best health insurance companies in India based on their CSR for the FY 2021-22 are:

- Care Health Insurance (100%)

- Niva Bupa Health Insurance (99.9%)

- Navi General Health Insurance (99.9%)

While selecting a health insurer for your healthcare needs, look for the following:

- Check for the coverage provided by the insurance company, the higher the better

- Check the sum insured amount offered and tally it with your actual requirements

Always go for a company with the best claim settlement ratio in health insurance