Raj’s car and health insurance plan were expiring soon. When he researched, he found the car insurance plan of another company offering him a better IDV (insured Declared Value) and also a lower premium. He wanted to switch but was unsure of the process and the implications of such switching. On the other hand, his health plan was bought after extensive research and was the best for his needs. He wanted to continue with it and wanted to know about renewals. He approached his uncle who happened to be an insurance expert and understood the concepts of portability (for his car insurance) and renewals (for his health plan).

Read more about Understanding IDV – Amount you can claim for Vehicle damage

In a car insurance or health insurance plan, there are two concepts which are common – porting and renewal. Both these concepts are applicable when the policy completes its tenure. However, these concepts are different. Let us find out the complete details about porting and renewal to understand them better.

What is portability?

Portability, in simple terms, means the ability to switch or change an existing health or car insurance plan. You can change your health/ car insurance provider and port to a health/ car insurance plan of another insurer. You can, also, port to a different plan of the same insurer. On porting, the accumulated benefits (waiting period and No Claim Bonus) of your existing health or car insurance plan would be carried forward to your new plan.

How does portability work?

Porting is like buying a new policy from a different insurer. The only difference is that the credits which you have accumulated in your old plan are added to the new plan. When the tenure of your existing plan is nearing completion, you can port out of your existing plan and shift to another one. The waiting period in your new health plan would be reduced by the period for which your old plan was in force. In case of your car insurance plan, the No Claim Bonus accumulated in the old plan would be used to discount the new premium.

When and why should you port?

Porting can be done only when the tenure of the plan completes and the plan is up for renewal. The reasons for which most of us port our policies are as follows:

- Lower premium – this is the most prominent reason of porting an existing plan. If another insurer is offering a lower premium, we can save money and, thus, portability makes sense. However, the new plan’s coverage should also be checked. If the coverage features of the new plan are lesser than the ones you are already enjoying, porting is not recommended, even if premiums are low. Lower premium should be the reason of porting only if the coverage is not compromised.

- Better coverage – if another plan is offering you better coverage features at the same or lower rate of premium, porting is feasible. In a car insurance plan, the Insured Declared Value (IDV) should be considered in the context of coverage offered. In health plans though, the coverage features should be given weightage.

- Better customer service – measure insurers on their after-sales service. If you are dissatisfied with your current insurer in terms of service, it is time to port.

Process to port a plan

Porting your health or car insurance policy is simple if you pay heed to some rules and follow some steps. Here is a guide on how to port a plan:

- Intimate your existing insurer of your decision to port.

- Such intimation should be given at least 45 days before the policy period completes. A lapsed policy cannot be ported.

- Shortlist another plan to which you would like to port.

- Inform the new insurer of the portability. For this too, the window of 45 days is required to be maintained.

- The new insurer would require you to complete and submit some documents. These documents include the proposal form of the new policy, a portability request form, copy of your old policy document and a cheque for the premium.

- Based on the underwriting principles of the new insurer, the policy would be ported and a new policy would be issued.

Disadvantages of Porting

Porting is a very good clause which helps in lowering premium outgo and/or increasing the scope of coverage. However, any No Claim Bonus (NCB) which would have accumulated in your health plan would be lost when you port. The enhanced Sum Assured (including the NCB) of the old plan would be treated as the base Sum Assured in the new plan.

What is renewal?

Your health or car insurance policy is issued for a specified term. While car insurance plans are for one year, a health plan can be taken for two or three years by paying the premium at once. When the stipulated term of the plan ends, it requires repayment of premium to continue the coverage. Renewal, therefore, means continuing the coverage by paying the premium for the next period.

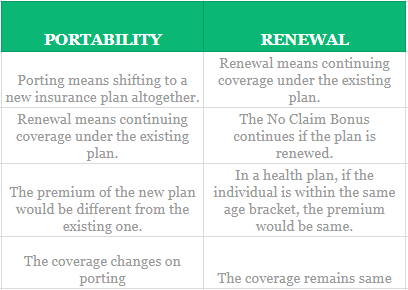

Difference and similarity between porting and renewal

While both portability and renewal are applicable when the policy tenure ends, these two terms are very different. Here’s how:

Porting and renewal are different terms with different meanings. However, both are applicable in a health and a car insurance plan. Understand the implications of these terms and get the best benefit of your health/car insurance plans.

Read more about All you need to know about car insurance

Read more about How to choose hassle free car insurance which is claim friendly

Feel free to leave your thoughts or comments below