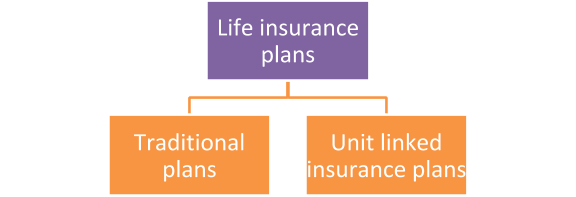

Life insurance plans come in many different variants. Broadly, life insurance plans are classified under two heads –

Traditional plans are those which promise guaranteed returns whereas under unit linked plans the returns depend on the performance of the market.

Table of Contents

- What is an endowment plan?

- How does endowment policy work?

- Salient features of endowment policy

- Best endowment plans of 2023

- How to buy endowment policy?

Traditional plans can be of different types and one such type is an endowment policy. Do you know endowment policy meaning? If you don’t here’s a complete lowdown on endowment insurance plans.

What is an endowment plan?

An endowment policy is a life insurance policy which helps you in creating guaranteed savings for your financial goals. The plan has a death benefit and also a maturity benefit. In case of death of the insured during the term of the policy, a promised death benefit is paid. Moreover, if the insured survives till the end of the policy tenure, a promised maturity benefit would be paid. Thus, endowment insurance plans cover both death and maturity and help in creating savings.

Types of endowment policy

Now that you know what is an endowment plan let’s find out the different types of endowment plans available. Endowment plans can be offered in two variants which are as follows –

- With profits or participating plans

Or

- Without profits or non-participating plans

With profits plans are those which earn bonus. If the life insurance company earns a profit in a financial year, the profit is distributed among the policyholders in the form of bonus. Participating policies are eligible to earn a bonus and if an endowment policy is offered as a participating or with profits policy, it would accrue bonus.

Without profits policy, on the other hand, do not earn bonus. Even though the insurance company declares a bonus, the bonus is not added to non-participating endowment plans.

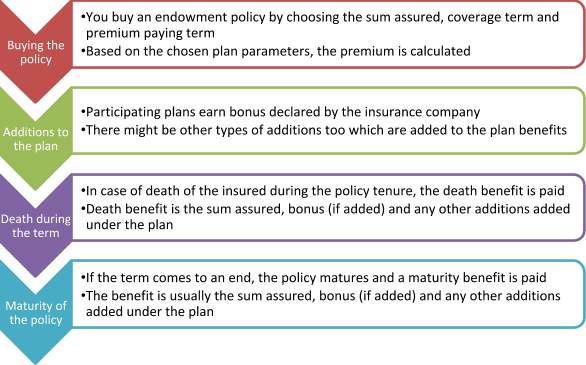

How does endowment policy work?

Here is a graphical representation of how endowment plans work for a better understanding –

Salient features of endowment policy

Here are some of the salient features which you can find in endowment policy –

- An endowment plan is offered for longer tenures which can go up to 30 years

- There are whole life endowment plans too which allow coverage till 99 or 100 years of age

- An endowment policy does not invest in capital markets. As such, the policy promises guaranteed benefits. Only the bonus, if allowed, is non-guaranteed since it depends on the performance of the company.

- Bonus is added under participating plans only if you pay the premiums as and when they are due

- There are optional riders under endowment insurance plans which help in enhancing the coverage

- Guaranteed additions or loyalty additions are added under many endowment plans

- There are regular premium, limited premium as well as single premium endowment plans. You can choose any plan as per your premium paying capacity

- You can avail policy loans under endowment plans. The loan is allowed against the surrender value of the plan

Benefits of endowment policy

Now that you have understood endowment plan meaning, its types and features, let’s see what makes these plans beneficial–

- The plan benefits are guaranteed protecting your savings from market volatility. An endowment policy is, therefore, suitable for risk-averse individuals who are looking at secured returns

- You can choose any policy tenure ranging from 10 to 30 years or even lifelong

- Endowment plans help you to create a guaranteed corpus for your financial goals

- If you buy participating plans, you can get an increased corpus through bonus additions

- The premiums that you pay for the endowment policy are allowed as a deduction from your taxable income. You can claim a deduction of up to INR 1.5 lakhs on the premiums that you pay

- Policy loans available under the plan helps you meet emergency financial needs at lower interest rates

- Even the plan benefits, maturity or death benefit, are completely tax-free in your hands under Section 10 (10D). Thus, endowment plans helps you to create tax-free savings for future needs

Best endowment plans of 2023

Here are the best endowment plans of 2020 which you can choose from –

HDFC Life Jeevan Sanchay Plus

This is a non-participating endowment plan which promises the following features –

- There are four benefit payment options under the plan. You can choose to receive the maturity benefit either in lump sum or in instalments under these options

- Maturity benefit can be chosen to be received as lifelong incomes till you reach 99 years of age

- Guaranteed additions are added under the policy

- There are two optional riders which you can choose for a wider scope of coverage

The parameters of the plan are as follows –

| Entry age | 5 to 60 years |

| Policy term | 6 to 20 years |

| Premium payment term | 5 to 12 years |

| Premium | Minimum – INR 30,000/annum

Maximum – no limit |

| Sum assured | Depends on the premium paid, age and the plan option selected |

ICICI Pru Cash Advantage

Cash Advantage is a money-back endowment plan wherein the sum assured is paid in instalments over the policy period. Let’s understand the salient features which make it the best endowment plan –

- Premiums are payable for a limited tenure only

- 1% of the Guaranteed Maturity Benefit is promised as Guaranteed Cash Benefit throughout the policy term

- Regular incomes are paid for 10 years after the completion of the premium payment term

The plan parameters are as follows –

| Entry age | 0 to 60 years |

| Policy term | 15, 17 or 20 years |

| Premium payment term | 5,7 or 10 years |

| Premium | Minimum – INR 30,000/annum

Maximum – no limit |

| Sum assured | 7 or 10 times the annual premium paid depending on age |

ICICI Pru Savings Suraksha

This is another endowment plan offered by ICICI Prudential which comes with both regular premium and limited premium payment options. The features of the plan which make it the best endowment plan are as follows –

- The plan is a participating endowment plan which helps you grow your corpus through reversionary bonuses

- Guaranteed additions are also added to the plan corpus in the first five years of the policy

Parameters of the plan are as follows –

| Entry age | 0 to 60 years |

| Policy term | 10 to 30 years |

| Premium payment term | 5 to 30 years |

| Premium | Minimum – INR 12,000/annum

Maximum – no limit |

| Sum assured | 7 or 10 times the annual premium paid depending on age |

LIC’s Jeevan Labh

LIC offers some of the best endowment plans and Jeevan Labh is one such plan which allows limited premium payments only. The features of the plan are as follows –

- Bonuses are declared under the plan which enhance the death or maturity benefit

- There are two optional rider coverage benefits which can be selected

- Premium discounts are allowed for choosing sum assured levels of INR 5 lakhs and above

Plan parameters include the following –

| Entry age | 8 to 59 years |

| Policy term | 16,21 or 25 years |

| Premium payment term | 10,15 or 16 years |

| Premium | Depends on age, sum assured and policy tenure |

| Sum assured | Minimum – INR 2 lakhs

Maximum – no limit |

LIC’s Jeevan Tarun Plan

LIC’s Jeevan Tarun plan doubles up as a child insurance plan for safeguarding your child’s financial future. The plan, therefore, acts as the best endowment policy for your child. The benefits of the plan are as follows –

- The child is covered under the plan while the parent is the policyholder

- There are four coverage options under the plan. Under these options, you can choose to receive the sum assured in money back benefits too

- If the money back benefit is chosen, a part of the sum assured is paid in the last four policy years

- Bonuses are added under the plan

- Premium waiver rider can be selected by paying an additional premium

- Premium discounts are available if the premiums are paid yearly or half-yearly

Parameters of LIC’s Jeevan Tarun are as follows –

| Entry age | 90 days to 12 years |

| Policy term | 25 years – entry age |

| Premium payment term | 20 years – entry age |

| Premium | Depends on age, sum assured and policy tenure |

| Sum assured | Minimum – INR 75,000

Maximum – no limit |

How to buy endowment policy?

To buy an endowment policy of your choice the online medium is the best option. Though you can buy a policy from a life insurance agent or from the insurance company itself, you don’t get a choice. There are various endowment insurance plans available in the market and when you compare you can buy the best endowment policy. Comparing can be done when you buy endowment policy online. The process is easy and quick. Turtlemint is an online platform which allows you to buy the best endowment policy for your needs. Turtlemint is tied-up with the leading names in the life insurance industry and offers you the choice of the best endowment plans. You can compare and buy the most suitable coverage for your needs. Besides offering you the choice of the best endowment plans, Turtlemint also offers personalised assistance for your queries and claim assistance. This makes your buying and claim process easy as a breeze.

To buy an endowment policy through Turtlemint, here are the steps that you should follow –

- Visit https://www.turtlemint.com/life-insurance

- Choose your financial need for which you are buying endowment plan. There are two needs which you can choose from – ‘Investment and tax planning’ and ‘Savings for Child’

- Then you would be required to enter your personal details which include the following –

- Gender

- Date of birth

- Annual income (so that the ideal sum assured level can be recommended)

- Smoking preference

- Investment horizon (for choosing the right coverage tenure)

- Investment amount and also the frequency (yearly, half-yearly, quarterly, monthly or one-time)

- Your contact details – name, mobile number and email ID. This is optional and is required so that Turtlemint’s team can contact you and help you buy the policy

- In the next page you get a choice between ULIPs and traditional plans

- Choose traditional plans to see the best endowment plans. You can also check the plan’s benefits and the premiums charged

- Compare the premiums vis-à-vis the benefit and choose the best endowment policy as per your coverage needs

Thus, when you buy through Turtlemint you can easily compare and buy the best endowment policy.

Documents required for buying endowment policy

You would have to submit some documents to complete the buying process for your endowment policy. These documents include the following –

- Your photographs

- Photographs of the life insured if you are buying the policy for someone else

- Identity proof of the insured

- Address proof of the insured

- Age proof of the insured

- Income related documents if you are opting for a high sum assured level and paying higher premiums

- Aadhar card and PAN card

- Things to remember when buying endowment policy

When you buy an endowment plan, here are some things which you should keep in mind –

- Ensure that the premium is affordable so that you can pay it over the term of the plan

- Endowment plans allow single premiums, limited premiums as well as regular premiums. Choose a premium paying term as per your affordability

- The term of the plan should match your investment horizon. Buy a plan keeping a financial goal in mind. These choose the term so that you get the funds when you need to fulfil the specific goal

- If you choose a participating plan, remember that bonus would only be paid if you continue paying the premiums. So, don’t let the policy lapse

- A lapsed policy can be revived within two years. Try and revive the policy for a wider scope of coverage

- Choose policy riders to increase the coverage of the endowment insurance plan

Endowment plans are low risk savings oriented life insurance plans which let you create a secured corpus over the term of the policy. So, if you want guaranteed returns, buy an endowment policy and create funds for your financial goals.

Frequently Asked Questions

1. What would happen if I stop paying premiums under an endowment plan?

If you stop paying premiums, the policy would lapse. If you have paid the specified minimum number of premiums, the coverage under the policy would continue on a reduced sum assured. This reduced sum assured is called paid-up value and the policy is called a paid-up policy. No future bonuses would be added to participating plans which are in a paid-up state. However, the accrued bonuses would be added to the paid-up value. In case of death or maturity, the paid-up value would be paid.

2. Can I surrender an endowment policy?

Yes, you can surrender an endowment policy if the policy has acquired a paid-up value. On surrender, you receive a surrender value which is calculated as the paid-up value multiplied by a surrender value factor. The factor is determined by the insurance company.

3. How much loan is available under an endowment insurance plan?

You can avail up to 90% of the surrender value as loan under endowment plans. However, the exact limit of loan varies across plans.

4. Are bonuses taxable?

No, the bonus that you earn from participating endowment policies is not taxable.