Monsoon brings a relief from scorching heat and an array of diseases. Dengue is one of them. It is a mosquito-borne painful fever caused by dengue viruses and the claim of this disease is increasing every year. Data from health insurer Max Bupa shows that reimbursement of dengue claim went up by 200% in 2015 compared to the previous year and this year the number could increase and that is why it is always better to be safe than sorry. Any illness needs extensive care and treatment but when it comes to dengue, needless to say, all the tests, treatment cost and hospitalization burn a big hole in your pocket. Health insurance comes handy in such situations. Now-a-days health insurance companies are coming up with specialized plans that cover for specific ailments. But how helpful or important specialized health insurance plans could be? If this question arising in your mind too, this is the right article for you. Read on to know more about dengue insurance cover.

What is dengue insurance cover plan?

Dengue insurance comes under the section of specialized health insurance plan that covers all dengue-related medical expenses. Apollo Munich has developed such specialized health plan known as DENGUE CARE PLAN and DHFL Pramerica has developed DENGUE SHIELD designed to treat solely dengue patient.

What does the apollo munich’s dengue care plan cover?

Here are the coverage features of Apollo Munich’s Dengue Care Plan:

- Inpatient treatment: the patient has to stay in hospital for more than 24 hours if treatment arising from dengue fever and hospitalisation cost cover up to sum assured.

- Room rent: the plan covers the rent of single private A/C room.

- Pre and post-hospitalisation: the plan covers any pre and post hospitalisation expenses for periods ranging 15 days immediately before hospitalisation and 15 days immediately after discharging from hospital.

- Shared accommodation benefits: the plan covers shared accommodation expenses.

- Outpatient treatment: these following benefits are available and covered under this section and cover expenses up to Rs 10,000

- Outpatient consultation by specialized doctor.

- Diagnostic tests for dengue fever.

- Expenses of medicine prescribed for dengue fever.

- Home nursing facility.

On other hand, DHFL provides 100% of the sum insured if you are diagnosed of dengue fever under the following conditions:

- If your platelet levels decrease rapidly below the minimal level.

- Minimum 48 hours inpatient care and hospitalization in a hospital.

- If your blood tests report shows positive for dengue.

When is the right time to buy this plan?

The answer is as early as possible. This policy covers persons from 91 days baby to 65 years old. For child the minimum entry age is 91 days and the maximum is 25 years. For adult, the minimum entry age is 18 years and maximum is 65 years.

Is the coverage beneficial?

A dengue patient entails a hospital stay of five to six days depending on the condition of the patient. In this scenario if you own such insurance plan, it makes life easier. The tests, the admission as well as the transfusion, if required, involve quite a lot of expenses. An article in Hindu states that Dengue treatment costs a bomb as corporate hospitals charge anything between Rs 10,000 to Rs 15,000 for a platelet separation, in case it is needed. Some people have ended up spending Rs 1.75 lakhs to Rs 2 lakhs for a dengue treatment of their children. With the rising cases of reported dengue, the need to look into this becomes very important.

But how beneficial these insurance plans are? To give you a clear idea on benefits of dengue insurance cover go through these pros and cons of such plan.

The pros:

- The Apollo Munich Dengue Care Plan does not require you to undergo any medical health test. In the proposal form, just a self-declaration is more than enough to buy this plan

- This plan allows upto Rs 10,000 for outpatient treatment, which is enough to avail treatment at your own house.

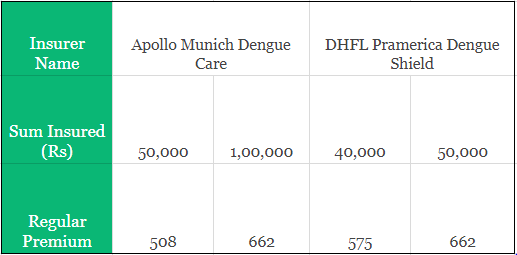

- The dengue cover’s premium rate does not depend on age. It depends only on the amount of coverage one wants from this plan. There are two coverage options available in Dengue Care Plan- one is of Rs 50000 and premium for this is Rs 508 inclusive of taxes and the other option is of Rs 1 lakh with premium Rs 662 annually.

- While DHFL Pramerica Dengue Shield plan offers a sum insured of Rs 25,000; Rs 40,000 and Rs 50,000. Here, you can pay the premium either annually or a single installment for a 5 year term.

As seen here, the cost for the benefits provided is very low. You pay only Rs 55 per month for Rs 1 lakh of coverage irrespective of your age from Apollo Munich’s Dengue plan.The cons:

- This plan only covers expenses for the treatment of Dengue. If you are suffering from any other ailment, this plan will not allow any coverage.

- This is an annual policy, thus you have to give the premium annually.

If you compare between your regular health insurance and specialized dengue insurance, you will see that besides the benefit of treatment at home, there are no special benefits that your regular health insurance does not provide.

However if do not have a regular health insurance and if you see dengue symptoms prevalent in your area, you should definitely consider at least buying this specialized dengue plan. The specialized dengue plan comes at a very low premium and since a disease like dengue is very uncertain, it makes a lot of sense to opt for it without much thought especially if you do not have any regular health plans.

You can also buy a Dengue plan alongside your regular health plan, since this plan comes without much pinch in the pocket. Moreover, if you have a dengue claim, you need not disturb the No Claim Bonus of your regular health plan. So, with the rising risk of Dengue in this country, this dengue special health plan can be seriously considered.

For any other queries with health insurance, get in touch with Turtlemint representatives.

Read more about Separate health insurance plans for parents of floater?

Read also An anatomy of an health insurance plan