‘A stitch in time saves nine’. Yes, we have heard this saying and read fables about this many times when growing up, but did we follow it? Procrastination is the say of the day and people always delay in completing chores which they consider is a burden. A health insurance policy too, though beneficial, is associated with money outflow, and hence, is constantly delayed. Youth often blinds us in its rosy picture and we feel that we are and will be disease-free till we hit the middle ages. This preconceived notion delays a health insurance purchase and it is not until later that we feel the harmful effects of such delay.

Delaying a health insurance plan involves costs, both literally and metaphorically. Let us see how we lose in both literal and metaphorical senses through delaying our health insurance plan:

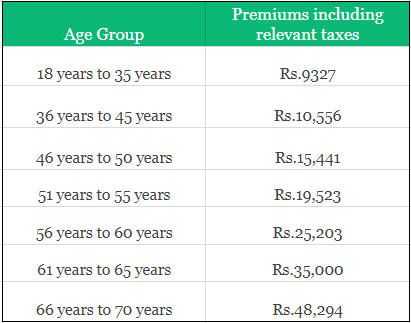

- Higher premiums – your age determines your health insurance premium. A higher age depicts a higher probability of contracting diseases and hence premiums are always high. So, if you delay in buying a health insurance policy, your premiums would increase and would literally cost you dearly. For instance, Apollo Munich’s Easy Health Premium Plan for a Rs.5 lakh Sum Assured has the following rates of premiums for an individual at different age groups:

So, you see, delaying a health plan is expensive and even the numbers prove that.

- Reduced coverage – there is a pre-existing waiting period clause in all the health insurance plans. This clause excludes the coverage of pre-existing illness which you have when buying the policy. When you delay buying a health insurance plan, you might develop some illnesses along the way. Such illnesses wouldn’t be covered in the initial few years of your plan. As compared to this, if you buy young you are free from any serious pre-existing illnesses. So, you get a comprehensive coverage and can wait out the waiting period. Later, when you actually contract any illness, the waiting period would have ended and you can enjoy a comprehensive coverage. Moreover, if at a later stage, any pre-existing illness becomes severe your health plan might be denied. Though health plans cover pre-existing illnesses after a specified waiting period, severe illnesses are not covered at all. Sad, but true!

- The necessity of medical check-ups – the pre-entrance medical check-ups which you dread would become compulsory if you buy a health plan late in life. Most health insurance plans require a pre-entrance medical examination for individuals above the age of 45 years. The cost of such examinations would be paid by the company, either in full or partially, only if the cover is granted and the policy is issued. So, if you delay buying the plan, you would have to undertake the required medical check-ups. Moreover, you might also have to shoulder the examination costs, either partly or completely (if the policy is rejected due to adverse medical findings).

- Compulsory clauses – many policies have a co-pay clause or a voluntary excess clause for people in the higher age groups. These clauses are compulsory and also heavy on your pockets. For instance, many policies include a 20% or 10% co-payment clause as the individual crosses 60 years of age. This means that in the event of any claim, 10% or 20% of the claim would have to be met by you.

The reasons show how a delay in making the health insurance purchase is costly both in literal and metaphorical terms. A health insurance plan has become a mandatory requirement in today’s age when medical expenses are touching the roof. When you would ultimately buy a health plan later, why not buy it young? You would be saving a lot in terms of premiums and coverage availed. After all, prevention is always better than cure, isn’t it?

Read more about 7 reasons why you should invest in health insurance early

Read also An anatomy of an health insurance plan

Read more about Dejargonizing health insurance terms