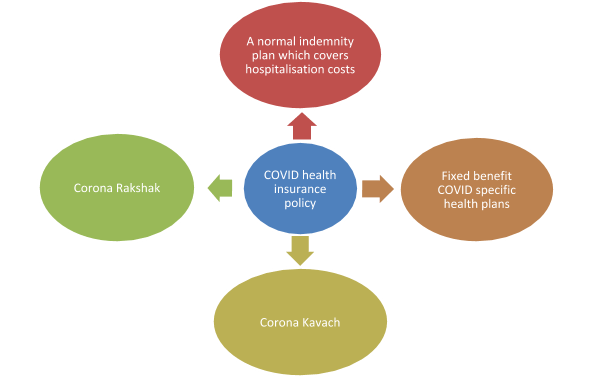

The Coronavirus pandemic is getting worse day by day as more and more individuals are being infected globally. In India, as of 27th August 2020, there are more than 7.29 lakh active cases of COVID infection (Source:Worldometers) while globally, the cases have touched the 24 million mark and the numbers are still climbing. (Source: Worldometers).As more and more individuals are falling prey to the virus, the need to face the financial implication of the illness has become important. That is why there is an increased emphasis on health insurance plans to cover the medical costs incurred due to Coronavirus. While the normal health plans offered by health insurers provide coverage for COVID related hospitalisation, new plans have also been developed for addressing the coverage needs of individuals. Health insurance companies and the Insurance Regulatory and Development Authority of India (IRDAI) have designed and launched specific COVID oriented health insurance plans to meet the demand for health insurance for COVID coverage. Let’s understand what these plans are

Types of COVID-19 health insurance policies in 2020

- Indemnity oriented health insurance plans

The indemnity health insurance plans which are offered by health insurance providers cover hospitalisation expenses. As such, if you are hospitalised due to Coronavirus, the expenses incurred on such hospitalisation and associated treatments would be covered under the existing health plan that you have.

- Fixed benefit health insurance plans

Seeing the rise in COVID cases, many health insurance companies launched a COVID specific, fixed benefit health insurance policy. These policies were launched under the Sandbox initiative of IRDAI on a trial basis. The policies promised the payment of the sum insured in lump sum if the insured tested positive for Coronavirus infection

- Short term, COVID specific health insurance policies

While the existing health insurance plans cover the cost of hospitalisation due to COVID, the cost of PPE kits and consumables are excluded. In case of COVID hospitalisation, such excluded costs constitute a primary portion of your medical bills and result in considerable out of pocket expenses. Moreover, the fixed benefit COVID specific plans were issued on a trial basis by few insurance companies making these plans not easily available. As such, IRDAI asked insurers to come up with a short-term COVID 19 health insurance plan which would cover only the medical costs incurred in case of Coronavirus. An English proverb says necessity is the mother of invention and the IRDAI’s directive resulted in the birth of two new COVID insurance plans – Corona Kavach Insurance and Corona Rakshak Insurance. Both these plans are short-term health insurance plans which provide coverage only when the insured tests positive for Coronavirus.

Corona Kavach Insurance Policy

The Corona Kavach insurance policy is an indemnity oriented health insurance plan which covers the costs incurred if you are hospitalised due to Coronavirus. The features of the policy are as follows –

- Individuals aged between 18 years and 65 years can buy the policy on an individual or family floater basis. For dependent children, the entry age is 1 day to 25 years. If, however, the child is aged over 18 years and is financially independent, the child would not be allowed coverage under the family floater plan.

- Under the family floater variant, self, spouse, dependent children, dependent parents and parents-in-law can be covered

- The sum insured start from INR 50,000 and goes up to INR 5 lakhs in multiples of INR 50,000

- There are three policy tenures to choose from – 3.5 months (105 days), 6.5 months (195 days)and 9.5 months (285 days)

- Coverage is available after a waiting period of 15 days. Coverage is offered only for hospitalisation due to COVID.

- The plan does not offer the benefits of lifelong renewals or portability

- Pre-existing illnesses as well as co-morbidities are covered under the policy

- A single premium is payable to buy the plan

- There is no limit on room rent coverage offered by the policy

- A 5% premium discount is offered to healthcare workers if they buy the policy

Coverage under the COVID Kavach health insurance plan is offered for the following –

- Room rent

- Boarding and nursing expenses

- ICU and ICCU room rent

- Fees payable to surgeons, doctors, consultants, anaesthetists and medical practitioners

- Cost of anaesthesia, oxygen, blood, ventilator, surgical appliances, medicines, diagnostics, PPE kits, masks, gloves and other consumables

- Cost of ambulance up to INR 2000

- Treatment taken at home, which would have otherwise required hospitalisation, for up to 14 days after being diagnosed COVID positive. In such cases, the cost of diagnostics, medicines, consultations, oximeter, nursing expenses, etc. would be covered. Home treatments would be covered only after obtaining an approval from the insurance company

- AYUSH treatments for COVID

- Pre-hospitalisation expenses for 15 days

- Post hospitalisation expenses for 30 days

Moreover, there is an add-on hospital cash benefit allowance which can be chosen at an additional premium. This benefit pays 0.5% of the sum insured for each day of hospitalisation for up to 15 days.

Corona Rakshak Health Insurance

Another standard COVID 19 health insurance plan is the Corona Rakshak health insurance plan. Contrary to Corona Kavach insurance, this plan is a fixed benefit health insurance plan. This means that the plan pays a lump sum benefit if you test positive for Coronavirus. The features of the plan are as follows –

- The plan is available on an individual sum insured basis only

- Adults in the age group of 18 years to 65 years can be covered under the plan.

- The policy comes in three durations – 3.5 months (105 days), 6.5 months (195 days)and 9.5 months (285 days)

- Sum insured is available from INR 50,000 to INR 2.5 lakhs in multiples of INR 50,000

- You can avail a premium discount if two or more family members are covered under the same plan on an individual sum insured basis

- No pre-entrance health check-ups are required to buy the policy

Coverage under Corona Rakshak health insurance plan

Corona Rakshak policy covers COVID infection. It pays the sum insured in lump sum if you test positive for Coronavirus and you are hospitalised for at least 72 hours.

Corona Kavach insurance premium

Being a short term COVID health insurance plan, Corona Kavach insurance premium is low and affordable. Though the coverage features are standard across all insurance companies, the premium varies. Here are the sample Corona Kavach insurance premium rates charged by different insurance companies for different tenures. The age is taken to be 35 years and the sum insured is INR 5 lakhs –

|

Insurance company |

Term 3.5 months |

Term 6.5 months |

Term 9.5 months |

|

IFFCO Tokio |

INR 1167 |

INR 2037 |

INR 2731 |

|

National Insurance |

INR 1360 |

INR 1975 |

INR 2385 |

|

Star Health |

INR 3831 |

INR 4597 |

INR 5172 |

|

Future Generali |

INR 552 |

INR 695 |

INR 839 |

|

Manipal Cigna |

INR 7748 |

INR 9535 |

INR 11,919 |

Premium rates for Corona Kavach

Being a short term COVID health insurance plan, the premium of Corona Kavach is low and affordable. Though the coverage features are standard across all insurance companies, the premium varies. Here are the sample premium rates charged by different insurance companies for different tenures. The age is taken to be 35 years and the sum insured is INR 5 lakhs –

|

Insurance company |

Term 3.5 months |

Term 6.5 months |

Term 9.5 months |

|

IFFCO Tokio |

INR 1167 |

INR 2037 |

INR 2731 |

|

National Insurance |

INR 1360 |

INR 1975 |

INR 2385 |

|

Star Health |

INR 3831 |

INR 4597 |

INR 5172 |

|

Future Generali |

INR 552 |

INR 695 |

INR 839 |

|

Manipal Cigna |

INR 7748 |

INR 9535 |

INR 11,919 |

Premium rates for Corona Rakshak

Similar to Corona Kavach, Corona Rakshak also has a standard coverage across all insurers but the premium rates vary. The premiums of different insurance companies are given below considering a sum insured of INR 2.5 lakhs and an age of 35 years –

|

Insurance company |

Term 3.5 months |

Term 6.5 months |

Term 9.5 months |

|

IFFCO Tokio |

INR 1028 |

INR 1795 |

INR 2406 |

|

Star Health |

INR 3846 |

INR 4615 |

INR 5192 |

|

Future Generali |

INR 321 |

INR 416 |

INR 512 |

Difference between the plans

Though both Corona Kavach insurance and Corona Rakshak plan are standard health plans offered solely for covering the medical costs incurred due to Coronavirus infection, both these plans are different. Here is a table showing the comparative difference between the two –

|

Points of difference |

Corona Kavach insurance |

Corona Rakshak insurance |

|

Type of policy |

Indemnity plan which covers actual medical costs |

Fixed benefit plan which pays a lump sum benefit |

|

Basis of coverage |

Both individual and family floater coverage allowed |

Only individual coverage allowed |

|

Sum insured |

INR 50,000 to INR 5 lakhs |

INR 50,000 to INR 2.5 lakhs |

|

Payment of claim |

On hospitalisation due to COVID for at least 24 hours or on home treatments |

On hospitalisation due to COVID for at least 72 hours. Home treatment is not covered |

Exclusions under Corona Kavach health insurance plan

Though Corona Kavach policy for COVID – 19 covers all possible medical costs of Coronavirus infection, it has exclusions too. These exclusions include the following –

- Cost of diagnostic investigation and evaluation for any medical condition not related to COVID

- Cost incurred in bedrest or recovery where no treatments are undertaken

- Cost of dietary supplements (vitamins, proteins, minerals, etc.)which are bought without any prescription

- Expenses incurred on unproven or experimental treatments

- Cost of treating Coronavirus when the infection was diagnosed before the policy started

- Costs incurred on day care treatments

- OPD expenses

- COVID related costs incurred during the waiting period of 15 days

- Medical treatments or diagnosis of COVID outside India

- Cost of COVID testing at a centre which is not authorized by the Government

- If the insured individual travels to any country where the Indian Government has put up travel restrictions, the coverage under the policy would stop

Exclusions under Corona Rakshak health insurance plan

Corona Rakshak policy does not provide coverage in the following instances –

- Costs of diagnostics and evaluation

- Claims which occur within the first 15 days from buying the policy

- Illnesses or diseases which are not related to Coronavirus

- COVID testing which is done at a centre that is not authorized by the Government

- Claim for COVID wherein the insured tested positive for the virus before the policy start date

- If the insured travels to a country where travel restrictions have been imposed by the Indian Government, the coverage under the policy would stop

Benefits of Corona Kavach insurance

Here are some benefits which you can get if you buy COVID Kavach insurance plan –

- Coverage for the cost of consumables incurred on treating COVID

- No out-of-pocket expenses in case of COVID treatments since the plan has no deductibles

- Comprehensive coverage since the plan covers co-morbidities as well as pre-existing illnesses

- Tax benefit on the premium paid under Section 80D of the Income Tax Act, 1961

- Affordable premiums which allow you to avail coverage for your whole family under a single plan

- Ease of buying the policy since no pre-entrance health check-ups are needed to buy the plan

Benefits of Corona Rakshak insurance

Corona Rakshak health insurance policy is beneficial because –

- It provides a lump sum financial benefit which you can use for meeting your treatment costs or for any other financial obligations that you have

- The premiums are affordable making it easy for you to buy the policy

- You can buy and avail coverage instantly since no pre-entrance health check-ups are needed

- The premiums are affordable and they also earn you tax benefits under Section 80D of the Income Tax Act, 1961

- The waiting period is very low allowing you coverage at the earliest. Moreover, the plan covers pre-existing illnesses and co-morbidities ensuring claim settlements in case of Coronavirus

Which one should you buy?

Both these policies are suitable for your short term coverage needs against COVID infection. Even if you already have an existing indemnity health plan, remember that the plan would not cover the cost of consumables in case of COVID hospitalisation. Since the cost of consumables would be high, you can buy Corona Kavach insurance which covers all possible costs incurred if you are hospitalised due to COVID. In fact, the COVID Kavach insurance plan also covers home treatment expenses thereby allowing you coverage for home quarantine too. While your normal health plan might not provide coverage for home treatments, the Corona Kavach insurance policy would and it would cover all possible costs incurred in treating you. The premiums are also quite low making the plan all the more feasible.

When it comes to Corona Rakshak health insurance plan, it gives you a lump sum benefit on hospitalisation for 72 hours or more. This benefit would help you meet the non-medical financial costs which you might suffer if you are tested positive for COVID. The plan, therefore, acts as a supplemental coverage which you can opt for if you have an existing indemnity policy.

Here is a comparative analysis of all available health insurance options for covering COVID costs –

|

Type of health plan |

Pros |

Cons |

What to do? |

|

Indemnity health plans |

|

|

If you don’t have health insurance at all, invest in a comprehensive indemnity health plan with a high sum insured for other medical contingencies. If you have a health plan, look for options to cover COVID related costs completely |

|

Fixed benefit COVID specific plans |

|

|

You can opt for these plans as supplemental plans for COVID |

|

Corona Kavach |

|

|

Buy the plans specifically for COVID related claims |

|

Corona Rakshak |

|

|

It can act as a supplemental plan to cover COVID related cases for additional financial assistance |

Both these policies are the need of the hour when COVID cases have become as common as the common flu. With more and more households falling victim to this dreaded illness, it is better to have complete coverage for the possible medical expenses that you would incur if you suffer from the infection. Corona Kavach and Corona Rakshak are short-term plans which cost low but provide complete financial protection against the medical expenses of COVID. So, invest in these plans and secure your finances against this pandemic.