Ratan was planning his investments when his friend asked him whether he had included a health insurance plan in his portfolio. Ratan hadn’t. He believed that being young (he was in his early 30s), he didn’t require health insurance. When Ratan mentioned why he didn’t buy a health plan, his friend then briefed him on the importance of a health insurance plan. Having heard what his friend said, Ratan realized the error of his beliefs and immediately invested in a health plan for himself and his family. What about you? Do you know the importance of health insurance or are you too caught up in your pre-conceived notions?

Read more about Why you should invest in health insurance early

Though the awareness of having a health insurance plan has increased, some of us still do not understand its importance. Which one are you? Kudos to you if you know the importance of health insurance! If you don’t, read on to know what Ratan’s friend had to say about why health insurance should be a part of your investment planning:

- Medical costs are injurious to your savings.

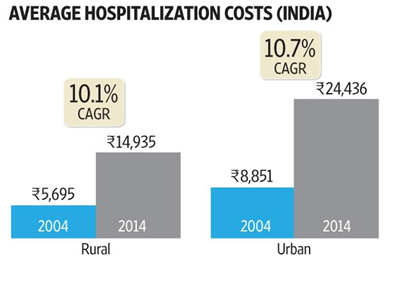

Do you know how high the medical costs have risen? The basic hospitalization costs have risen by more than 10% in a decade. Given below are the findings of the survey conducted by National Sample Survey Office in 2014:

If hospitalization costs have increased so much, think about the cost of medical procedures. Wouldn’t they be high as well? Can you tackle these expenses yourself?

Medical inflation is forever on the rise, which increases medical costs. Increased medical costs deplete your wealth and savings. What is the point in creating all those investments if you do not have a health plan to protect them from being depleted? A health insurance plan is designed to take care of these increasing medical expenses. By paying such expenses, the plan protects your savings from being drained out in case of a medical emergency.

Read more about How cashless insurance can save you the day when money ends

- You can get tax exemption under Section 80D.

Don’t you invest with a view to save your taxes as well? Your health insurance plan helps in this regard too. Health insurance premiums paid for yourself and your family (including your dependent parents), are exempted from tax under Section 80D. You can, thus, claim up to Rs.60, 000 as tax exemption if you pay health insurance premiums for self and your dependent parents (if both are senior citizens).

- Health insurance helps in retirement planning too.

Did you know that health plans come with a lifelong renewability feature? Yes, you can now renew health plans for as long as you are alive without any maximum renewal age. This is helpful, especially after you retire. In your old age, your income is low and the probability of medical contingencies is high. If you have a health plan, any medical contingency you face would be covered by your health plan thereby sparing your savings. Here’s a word of caution, though. To enjoy lifelong renewability, you should not only buy a health plan, but also ensure its timely renewals.

- Teach your children the power of a health plan.

If you inculcate the habit of making a health insurance investment, your children, too, will learn the importance of having a health insurance policy. This knowledge helps your children to include a health insurance plan in their investment planning and enjoy its benefits. So, learn the importance of health insurance yourself and then impart this knowledge to your children.

We invest for wealth appreciation and a health insurance plan helps in safeguarding your investments against medical contingencies. If the rising healthcare costs are any indication, you should invest in a health insurance plan at the earliest. Furthermore, health insurance investment is not a one-time deal. Timely renewals are also required to continue the plan benefits. Having a valid cover throughout your life helps after retirement too when your plan pays for all of your medical expenses. Ratan was duly educated about investing in a health insurance plan, were you?

Read more What is insurance and how does it work?

Read more 7 Reasons you should invest in health insurance early

Read more 4 Reasons why health insurance is an important investment

Also, check out our video below to understand why health insurance is an important investment

Feel free to share your comments below