PAN and Aadhaar:

A PAN number is your Permanent Account Number which is used when you do financial transactions. Your PAN Card contains the number and the number is unique for every individual. Similarly, an Aadhar card also contains a 12-digit unique identification number which is allotted to you buy the Unique Identification Authority of India (UIDAI). The number contains your demographic and biometric details and helps in identification.

Since both PAN and Aadhar help in the identification of individuals, the Government of India made it mandatory for individuals to link their PAN cards with their Aadhar Cards in the Union Budget of 2017. This law was also upheld by the Supreme Court and PAN Aadhar link has become essential. In fact, if you are a tax-payer and want to file your taxes, you would have to mandatorily link your PAN Card with Aadhar card to complete the tax filing process.

Do you know how to link Aadhar with PAN Card?

Importance of linking Aadhar card with PAN card

Here are some reasons why the Government of India mandated the linking of Aadhar card and PAN card –

- To avoid tax evasion

Many individuals try and avoid paying their tax liabilities. This is called tax evasion which reduces the revenue earned by the Government. When both the Aadhar card and PAN card would be linked, authentication of individuals would become easier thereby reducing the instances of tax evasion. - To discourage multiple PAN Cards

Many tax-payers apply for multiple PAN cards to reduce their tax liabilities. They divide their incomes between the multiple PAN cards that they have so as to minimise their tax liability. However, since Aadhar card is issued only once, linking of Aadhar card and PAN card would remove the practice of applying for multiple PAN cards. - To file taxes easily

Since PAN Aadhar link has become mandatory for filing taxes when you link your cards you would be able to file your taxes easily without any problems.

How to link Aadhar with PAN Card?

There are different ways in which you can link your Aadhar card with your PAN Card. Let’s have a look into them –

- Through the Income Tax -filing website

If you are a tax-payer, you must be registered with the e-filing website of the Income Tax Department. As a registered user, you can easily link your Aadhar card with your PAN Card through the following steps –

- Visit the e-filing website of the Income Tax Department which is https://www.incometaxindiaefiling.gov.in/home

- Since you are a registered user, log into your online account by entering in your user ID, password and the captcha code displayed

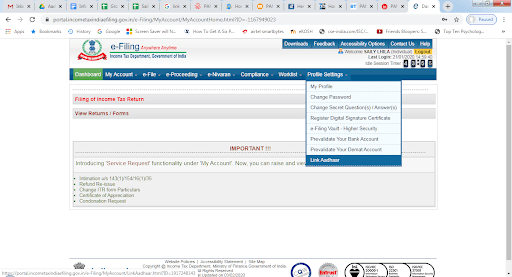

- On your dashboard, go to ‘Profile Settings’ and then choose ‘Link Aadhar’

- A form would be displayed which you should fill up providing your name, date of birth, gender, PAN card number, etc.

- Then provide your Aadhar card number and the captcha code displayed therein

- Enter ‘Submit’ and your Aadhar card would be successfully linked with your PAN card. You would also get a message showing that the PAN Aadhar link has been a success

If, however, you are not a registered user of the Income Tax e-filing website, then also you can link your Aadhar card with PAN card without registering yourself. The process is as follows –

- Visit https://www.incometaxindiaefiling.gov.in/home and on the home page you would find a ‘Quick Links’ section at the left-hand side of the page

- Under ‘Quick Links’ you would be able to see the option of ‘Link Aadhar’

- Choose the link and a new page would open

- Provide your PAN card number, Aadhar number, name as mentioned in your PAN Card and enter the captcha code displayed

- After all the details have been entered, click ‘Link Aadhar’ and your Aadhar Card would be linked to your PAN card. You would be shown a message showing the success of the PAN Aadhar lin

- Through an SMS

Linking your Aadhar Card with your PAN card can also be done by sending an SMS from your mobile phone. However, for this method to work, the same mobile number should be registered with both your Aadhar Card and PAN Card. To do the linking the SMS should be sent to the entities which provide the services of issuing your PAN Card. These entities are NSDL e-Governance Infrastructure Limited and UTI Infrastructure Technology and Services Limited. You can send an SMS to either of these entities and the linking would be done. The text of the SMS should be in the following format –

UIDPAN<Space><12-digit Aadhar Card Number><Space><10-digit PAN Card number>

This message should be sent to the number 567678 or to the number 56161. You would, then, receive a confirmation message and once the PAN Aadhar link is done you would also get a message of successful linking on the same mobile number.

- By filling up Annexure I of the Aadhar PAN Linking form

The Central Board of Direct Taxes also allows manual linking of your Aadhar card with your PAN Card. To do so, you would have to visit the nearest service centre of either NSDL e-Governance Infrastructure Limited or UTI Infrastructure Technology and Services Limited. At the service centre, you would have to fill up Annexure I which is for linking your PAN and Aadhar Card. The filled up form should be submitted with self-attested copies of your Aadhar card and PAN card. A prescribed fee would have to be paid for completing the linking process. If there are any corrections to be done in the Aadhar card or the PAN card, the same would be done at the time of linking. Moreover, the authentication of your biometric details might also be done by the service centres if there are major differences in the data of PAN card and Aadhar card.

PAN Aadhaar link for NRIs

In some cases, NRIs are also required to file tax in India on the income that they earn in India. However, for tax filing of NRIs, PAN Aadhaar link is not necessary. As per Aadhaar (Targeted Delivery of Financial and Other Subsidies, Benefits and Services) Act, 2016, an Aadhaar card is issued only to resident Indians. NRIs would not be issued an Aadhaar card. Since the card is not allowed for NRIs, NRIs are not required to do any linking.

Points to remember for PAN Aadhaar link

There are some points which you should remember when you are linking your PAN Card with your Aadhaar card. These things are as follows –

- Your mobile number should be linked to your Aadhaar card so that you can get a verification OTP. If the mobile number is not linked with Aadhaar card, PAN Aadhaar link would not be possible. In that case, you should, first, get your mobile number registered with Aadhaar.

- If there is any mismatch in your name, date of birth or gender in your Aadhaar card and PAN card, get the mismatch rectified before you opt for PAN Aadhaar link. Rectification can be done either in the Aadhaar card on in the PAN card.

Ensure that you enter your Aadhaar card number correctly at the time of linking it with the PAN Card so that the linking is done successfully.

Here is the Information on how to check PAN Link Status

You should, therefore, link your Aadhar card and your PAN card before the due date so that you don’t face problems due to non-compliance with the mandatory rules.

FAQ’s

No, the facility of linking the Aadhar card with the PAN card online or through SMS would be completely free of cost. However, in case of linking through SMS, the mobile carrier rates on sending the SMS would apply.

Yes, online linking of Aadhar card and PAN card would be allowed even if there is a mismatch in the names contained on both the cards if the date of birth is the same. In such cases, an OTP would be sent to your registered mobile number to complete the linking process. Once the OTP is entered the linking would be complete.

The last date for linking PAN Card with Aadhar card has been granted up to 31st March 2020. If the linking is not done before this date, the PAN card would become inoperable.

An Aadhar card is granted only to a resident Indian individual. NRIs are not issued an Aadhar card and so they would not be allowed to link their PAN cards with their Aadhar cards. The mandate for linking Aadhar card with PAN card would, therefore, not apply to NRIs.

No documents are required when you are linking through the e-filing website of the Income Tax Department or through an SMS. However, if you are linking your cards by visiting the service centres of PAN service providers, copies of your Aadhar card and PAN card would be required.

Your Aadhaar number is necessary when you file your income tax returns. However, if you have applied for an Aadhaar card, you must have an enrolment ID which is provided by the enrolment agency when you apply for the Aadhaar card. If you do not get the Aadhaar card at the time of filing your income tax returns, you can quote the enrolment ID in place of your Aadhaar number and file your taxes successfully.