Every vehicle owner in India is required to own a mandatory vehicle insurance policy if he/she owns a vehicle. This mandate is specified under the provisions of the Motor Vehicles Act, 1988 which also lays down other traffic-related rules in India. According to the Motor Vehicles Act, 1988, your vehicle must be insured under a third-party liability policy. This policy protects the financial liabilities that you might suffer if you cause physical injury, death or damage to a third party.

Table of Content

- Importance of Checking Vehicle Insurance Online

- Different Ways to Check the Status of Vehicle Insurance Online

- How to check vehicle insurance policy status?

- Checking Vehicle Insurance Policy Status Online?

- Checking Vehicle Insurance Status Online on the Parivahan Sewa

- Checking Vehicle Insurance Status Online on the RTO

- Checking Car Insurance Details on the mParivahan App

- Search Guidelines for IIB Portal

- Checking Car Insurance Status through a QR Code

- Checking vehicle insurance policy status offline

- Checking vehicle insurance policy status through the VAHAN portal

- Vehicle registration number – what you need to know?

- What if you don’t have the vehicle registration number?

- FAQs

Importance of Checking Vehicle Insurance Online

Simply buying insurance for your vehicle isn’t enough. You need to make sure at all times that it is active and running to avoid any last-minute unforeseen events. This is why it is essential to do a periodic vehicle insurance check and keep track of the status of your vehicle insurance. The good news is that you can now easily check the status of your vehicle insurance online since many vehicle insurance providers offer online services to customers. The process is highly convenient and also averts the possibility of you having to drive on the road without a valid insurance policy.

Here are some key reasons why it is necessary to do a vehicle insurance status check online from time to time:

- It ensures that you continue enjoying the benefits of the policy, i.e., financial coverage benefits in case of a road accident or any other unforeseen event.

- It ensures that the validity of your third-party insurance remains intact and you do not miss renewal deadlines.

- It ensures that you do not end up paying unnecessary penalties for driving without a valid insurance policy.

Different Ways to Check the Status of Vehicle Insurance Online

Now that we understand the importance of checking vehicle insurance and also know of the convenience of doing so online, let us look at the various ways in which you can run a vehicle insurance check online. Listed below are a few official portals that can be used for the task:

- RTO portal where the vehicle registration has been done

- Parivahan Sewa

- IIB Portal

- VAHAN

- mParivahan app

- Official website of the insurance provider from whom you purchased the vehicle insurance policy

How to check vehicle insurance policy status?

The status of your vehicle insurance policy shows whether your policy is active or lapsed. Moreover, you can get the details of your insurance coverage when you check insurance status of your vehicle.

You can do a vehicle insurance check online or offline. Both modes allow you to check whether your vehicle insurance policy is active or not.

How to Check Vehicle Insurance Policy Status Online?

We listed above a few popular official websites that can facilitate the process of how to check the insurance of a vehicle online. There are a few simple steps involved in the process that can further expedite and simplify the procedure:

- Start with going to the official portal of your insurer where you purchased the vehicle insurance policy.

- You will be asked to fill in a few key details on the form that appears on your screen, such as details of the policy and contact details of the policyholder.

- After submitting the required details, you will now be able to check the status of your vehicle’s insurance on the screen.

Process to Check Vehicle Insurance Status Online on the Parivahan Sewa Website – Steps

Among the many sources that allow for checking vehicle insurance status online, the Parivahan Sewa website is a popular and reliable portal. Given below is the simple step-by-step procedure on how to check vehicle insurance details on the Parivahan Sewa portal:

- Go to the official website of Parivahan Sewa – https://parivahan.gov.in/parivahan/.

- Go to the menu bar on the home screen and click on ‘Informational Services’.

- A drop-down menu will open up. Select ‘Know Your Vehicle’s Details’ from the list.

- The webpage ‘VAHAN national register e-services’ opens up.

- You must log in using your registered mobile number on this page.

- An OTP will be shared on your registered mobile number. Enter it for verification along with the registration number of the vehicle.

- Go to ‘Search Vehicle’ and using the vehicle’s registration number, check the status of your insurance.

- The details of your vehicle insurance policy will appear on the screen.

Process to Check Vehicle Insurance Status Online on the RTO – Steps

Along with the Parivahan Sewa website, the RTO portal is yet another means of checking vehicle insurance status online. Below are the steps to do so:

- Go to the official portal of the state transport office RTO.

- Select ‘Online Services for Citizens’ and then click on ‘Vehicle-Related Online Services’.

- Next, select ‘VAHAN Citizen Services’.

- Enter the details of the RTO branch where the vehicle has been registered.

- Go to the menu bar and click on ‘Status’.

- Then select ‘Know Your Vehicle Details’.

- Key in important details such as the registration number of the vehicle, engine number, and chassis.

- You will also be required to solve and enter the CAPTCHA code along with the above details.

- You can now view the complete details of your vehicle insurance and check the status of the insurance policy sitting in the comfort of your home.

Check Car Insurance Details on the mParivahan App

You can also easily check your car insurance details on the mParivahan app which further simplifies the process and makes it extremely convenient for customers to access key information on the tips of their fingers.

- You would first need to download the mParivahan app on your mobile phone or any other device you’d like to use.

- Now select the language of your preference to receive the instructions on the app.

- Hit ‘Continue’. A dashboard on the screen offers two options to check the status of your vehicle insurance. You may choose to check the status either using the driving license or the registration number of your vehicle.

- Hit ‘Search’.

- Sign in using your registered mobile number and check the status of your insurance on the app.

Search Guidelines for IIB Portal

The IIB portal is yet another reliable source to check insurance status by vehicle number. All you need to do is follow the simple steps below:

Step-1: Go to the official portal of the Insurance Information Bureau (IIB).

Step-2: Find ‘Quick Links’ on the main screen and select ‘V-Seva’.

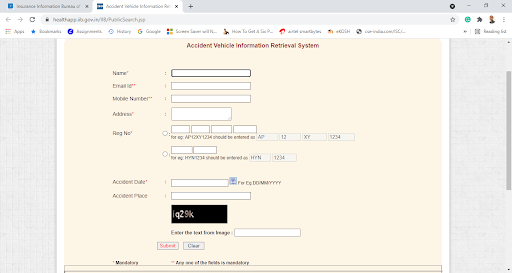

Step-3: The page on ‘Accident Vehicle Information Retrieval System’ opens up.

Step-4: Enter the required details, such as your name, contact number, address, and email ID.

Step-5: You will also be asked to provide the registration number of your vehicle.

After submitting the desired details, you will be able to check the status of your insurance online if your vehicle is already registered on the IIB website.

How to Check Car Insurance Status through a QR Code?

This is yet another simple and convenient method to check the status of your car insurance policy. With the IRDAI mandating all car insurance providers to provide a QR code with every policy issued, the code can be used to determine the status of car insurance. All you need to do is scan the code through the scanner on your mobile and you can get the complete details regarding your car insurance policy on your mobile instantly.

How to check vehicle insurance policy status offline?

Whether you own a car or a bike, you can check insurance status of your vehicle through the following offline modes

- Visit the insurance company’s branch office. Provide your policy number and the company would tell you the vehicle insurance status instantly.

- You can also call the customer care number of your insurance company and check insurance status of your car or your bike.

- Alternatively, you can visit the Regional Transport Office (RTO) of your city and enquire about your vehicle’s insurance status. You would have to provide your vehicle registration number and the policy number to check the vehicle insurance status.

How to check vehicle insurance policy status through the VAHAN portal

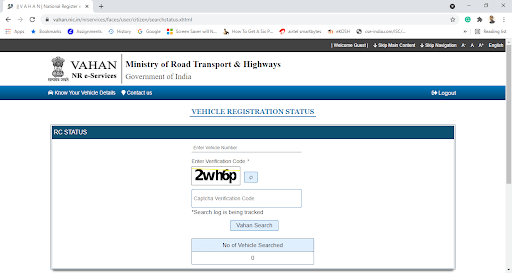

The VAHAN portal is the national register for online services introduced by the Ministry of Road Transport & Highways. You can create your account by providing your mobile number and then use the services offered by the website. One such service is tracking the status of your insurance policy. To do so, here are the steps

- Create your online account by providing your mobile number and email ID

- Then click on ‘Know your Vehicle details’

- Provide the registration number of your car or bike and enter the verification code to proceed

Vehicle registration number – what you need to know?

Your vehicle’s registration number is a key detail that is needed when you want to check the status of your vehicle insurance policy. The registration number is mentioned on the number plate of your vehicle. It is a 10-digit alpha-numeric number where

- The first two alphabets represent the State code

- The next two digits are the District code

- The next two alphabets are the Series code

- The last 4 digits are the number for your vehicle

You need the vehicle registration number to

- Buy or renew a motor insurance policy

- Make a claim on your motor insurance policy

- To transfer your vehicle second-hand

- To check the status of your vehicle insurance policy

- For other vehicle-related services that you need

What if you don’t have the vehicle registration number?

If you don’t have the vehicle registration number, you can check your vehicle’s RC book. The registration number would be mentioned therein. Alternatively, you can check the policy bond which contains your vehicle’s registration number. You can also visit the local RTO to find out about your vehicle’s registration number.

The registration number is an important detail that should not be missed.

FAQ’s:

A copy of your bike insurance can be downloaded from the website or app of the insurance company that you purchased your bike insurance from. You can log in to your account on the insurer’s portal and enter your policy number or registered mobile number to search for your policy. Alternatively, your bike insurance copy is available for download on your registered email ID as well.

A new car insurance policy is generally issued for 3 years and will be provided to you by the car dealer where you bought your car from. At the end of 3 years, it is best to check whether the policy has lapsed, for which you can check the status of your insurance online in many convenient ways.

Yes, you can check your vehicle insurance status even without your policy number. In fact, the IIB portal, as well as the VAHAN portal, do not require your policy number. You just have to mention the registration number to check your insurance status.

Alternatively, you can also contact your insurer and ask for your vehicle’s insurance status without the policy number. In this case, you would have to provide your registration number and verify your personal details.

When you check your insurance status and find that the policy has lapsed, you should renew the coverage as soon as possible to avoid legal penalties. To renew, request your insurer to renew the coverage. An inspection of your vehicle would be done and then your policy would be renewed after you pay the renewal premium.

No, there is no limitation on the number of times you can check the status.

Yes, you can check the insurance status of another vehicle by using its registration number. In fact, if you are in an accident and you want to make a third-party claim on another vehicle, you can check the vehicle’s insurance status through the IIB or the VAHAN portal and then lodge a claim on another individual’s policy.