If you have recently started a job or are planning to take one up soon, knowing some specific salary terms might be a necessity. Terms like gross salary, net salary, CTC, etc, are often misunderstood for having the same meanings. Though they are used commonly, most people do not really know what words like take-home salary or CTC mean, and what their differences are. Read on to clear your doubts and to avoid any kind of heartburn that may be created later:

What is Salary?

Salary is an amount paid by the employer to the employee in exchange for his services in the company either monthly or annually. The salary of an individual can depend on a lot of factors like his/her profession, demand and supply, location, skills, experience, tax bracket they fall into, and their salary structure. There are some important components of salary like net salary, gross salary, take-home salary, and cost to the company (CTC) that needs to be understood by every employee before proceeding for employment.

What is Cost to Company (CTC)?

CTC means the expenses that the company bears for hiring the service of its employee. CTC includes all the salary components such as basic salary, house rent allowance (HRA), travel allowance, pension fund, provident fund, medical insurance and incentives (if there are any). CTC should not be confused with the take-home salary as this is a cumulative salary of all direct and indirect benefits.

CTC= Direct Benefits + Indirect Benefits + Savings Contribution

Components of CTC

| Direct Benefits | Indirect Benefits | Savings Contribution |

| * Basic salary * Conveyance allowance * Dearness allowance * House Rent Allowance * Medical Allowance * Vehicle Allowance * Leave travel Allowance * Internet/phone Allowance * Special allowances/ City Compensatory Allowance * Incentives/bonuses | * Interest-free loans * Subsidized meals and Food coupons * Company leased accommodation * Medical and life insurance premiums to be paid by the employee * Income tax Savings * Office space rent | * Super Annotation benefits * Employer Provident Fund (EPF * Gratuity |

Let us take a look at the major components oF CTC in detail:

- Basic salary

Your basic salary is the component that will never vary, unlike other components. Your basic salary will always be a part of your in-hand salary. - Allowances

This is an amount paid by the company to help the employee meet his daily service requirements. This amount varies from company to company. - House rent allowance

This amount is paid to the employees if he/she stays in rented accommodation. - Leave travel allowance

This amount is paid by the company to cover the domestic travel expenses of his employee for service purposes. Nevertheless, this amount will not include the employee’s food and accommodation for the employee. - Dearness allowance

This is a living allowance paid to government employees, private sector employees, or pensioners only. This allowance helps the employees to tackle the effect of inflation. - Vehicle/fuel allowance

This amount is provided to the employee as reimbursement to fuel and vehicle used for service in a financial year. - Internet/phone allowance

The company allows the payment of the employee’s phone and internet bills used for the service up to a certain limit. - Employee Provident Fund

This is a corpus amount collected by the employer for the retirement scheme of the employee - Gratuity

This is an amount that is deducted from the salary of an employee and is awarded to him as a token of gratitude by the company at his retirement.

Let us take this example, Tarun Bhatia is a 32-year-old male, working in a software company with a CTC of INR 4,00,500. The breakdown of this salary on an annual basis is as follows:

| Salary Components | Amount |

| Basic Salary | INR 1,92,600 |

| House Rent Allowance (HRA) | INR 1,06,300 |

| Conveyance Allowance (CA) | INR 19,674 |

| Medical Allowance | INR 15,000 |

| Employee Provident Fund (EPF) | INR 21,600 |

| Gratuity | INR 18,326 |

| Special Allowance | INR 27,000 |

| Cost to Company | INR 4,00,500 |

Explanation of Cost To Company (CTC) with some solved examples

Let us try to further understand what CTC means, with the help of these examples:

Example 1:

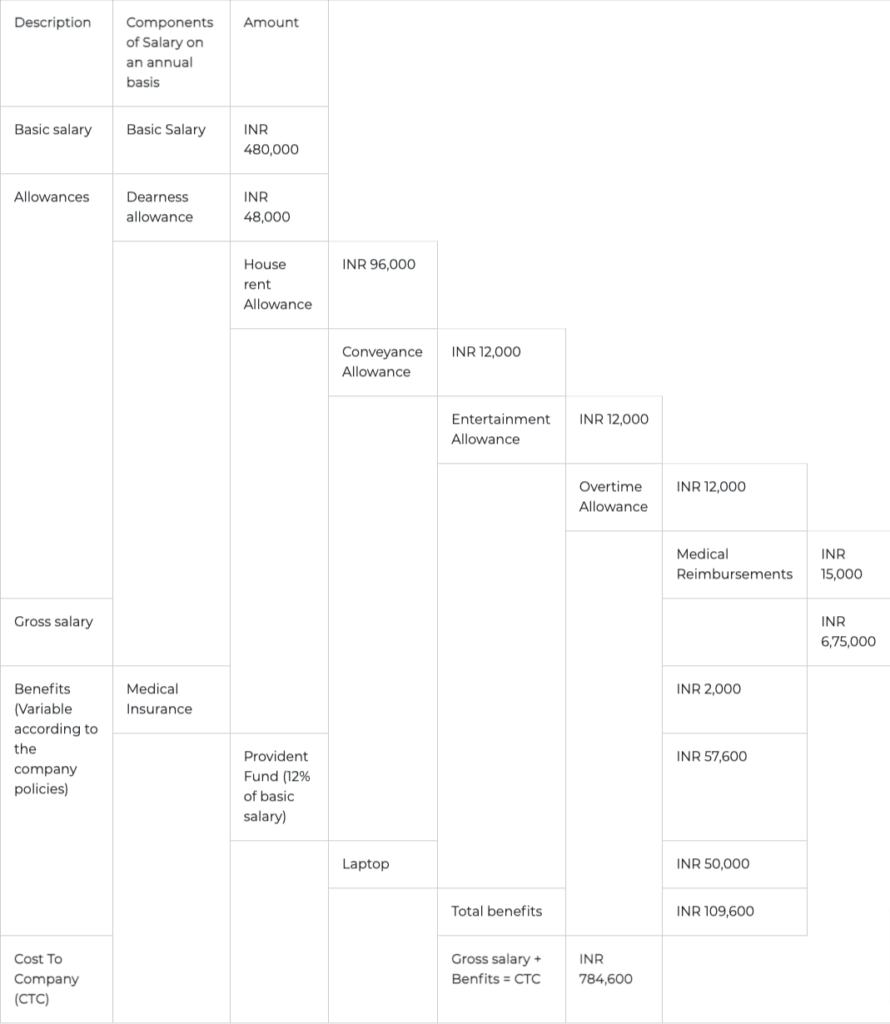

Tanay Chatterjee is a 25-year-old male who has just completed his MBA and has been selected in a finance company through his college campus with a basic salary of INR 480,000. There are a lot more components mentioned in his offer letter and now he wants to calculate the CTC offered by his company.

Let us see how:

Gross Salary:

The simple meaning of Gross salary is the amount you get on the subtraction of gratuity and EPF aunts from the CTC offered by your company. Gross salary is still not the salary you will take home as there are more deductions to be made for taxes and overtime bonus, etc.

Continuing with our example, let’s calculate Tarun’s gross salary on an annual basis:

| Salary Components | Amount |

| CTC | INR 4,00,500 |

| Less: Employee Provident Fund | INR 21,600 |

| Less: Gratuity | INR 18,326 |

| Gross salary | INR 360,574 |

Net salary/ Take-home salary

Very suggestive from its name, this is the amount that the employee takes home. It is also called the in-hand salary. This amount is calculated by subtracting tax amount and other additional bonus amounts from the gross salary of the employee.

Let’s now calculate Tarun’s net or take-home salary. As his salary falls between INR 2.5 lakhs – INR 5 lakhs, he is eligible for a 10% tax payment according to the tax slab.

| Salary Component | Amount |

| Taxable Amount | INR 360,574 |

| Less: tax amount (10%) | INR 36,057.4 |

| Net salary | INR 324,516.6 |

What is the Gross salary? What do you mean by gratuity?

Gross salary is the salary that is inclusive of basic salary, allowances, and bonuses without any deductions of tax, employee provident fund contribution, and gratuity. In simpler words, gross salary is the amount availed by subtracting EPF and Gratuity amounts from CTC.

There can be two formulas to calculate the gross salary:

- Gross Salary= Basic salary + Allowances (HRA+LTA + DA+CA+others)+ bonus+ Reimbursements

- Gross Salary= Cost To Company (CTC) – Employee Provident Fund (EPF) – Gratuity

Gross salary should not be confused with the net salary or take-home salary as there are deductions to be made in this amount.

Gratuity

Under the Payment of Gratuity Act, 1972, employees can be paid a gratuity amount for the services provided by them over their years of employment. This gratuity amount is offered to the employee at the time of his/her retirement from the company as a token of gratitude. Employees are eligible to avail gratuity and other similar incentives by the organization only after a period of 5 years. In case of an emergency like death, disability caused due to accidents, etc the employee can be provided with the amount. The gratuity amount is deducted from the employee’s salary on a monthly basis.

Gratuity is generally calculated using this formula,

Gratuity = 15 X Last Drawn Salary X Tenure / 26

Explanation of Gross Salary with a solved example:

Gross salary is different from net salary as deductions like tax amount and EPF needs to be made from it. When we subtract EPF and Gratuity amount from the Cost to Company amount, we get the gross salary of an employee.

Kabir Rathore is a 29-year-old male who has recently joined an IT firm with a net salary of INR 5,93,000. Let us take a look at his gross salary:

| Salary Components | Amount |

| Basic Salary | INR 3,00,000 |

| House Rent Allowance | INR 1,20,000 |

| Leave and Travel Allowance | INR 60,000 |

| Special Allowances | INR 1,40,000 |

| Gross Salary | INR 6,20,000 |

What is net salary or take-home salary?

Net salary is the actual amount that the employee takes home after all aggregations and deductions are made. The net salary is often referred to as take-home salary or in-hand salary. Net salary is calculated after making income tax deductions at source (TDS), provident fund, and other deductions according to the company policy. Thus, net salary= Gross salary- EPF contributions – tax deductions

How to calculate net salary or take-home salary?

- 1st Step

You need to calculate the gross salary

Gross salary is equal to your CTC – deductions for EPF and Gratuity. - 2nd Step

Then, you need to calculate your taxable income.

To calculate taxable income, we need to subtract the allowances (HRA, LTA, CA, etc), health insurance, other investments in tax-saving instruments and all other deductions from the gross salary of the employee. - 3rd Step

Then, you need to calculate your tax amount according to the new tax regime (If you are opting for the same) which is:

| Income Range | Tax Rate |

| From 2.5 lakhs – 5 lakhs | 5% |

| From Rs. 5 lakhs – 7.5 lakhs | 10% |

| From Rs. 7.5 lakhs – 10 lakhs | 15% |

| From Rs. 10 lakhs – Rs. 12.5 lakhs | 20% |

| From Rs. 12.5 lakhs – Rs. 15 lakhs | 25% |

| Income over 15 lakhs | 30% |

- 4th Step

You need to calculate your net salary, which is also known as your take-home salary. This is basically the amount of money you get in your bank account every month.

So, your take-home income or salary is equal to your gross salary minus the total amount of Income Tax deductions.

Explanations of Net salary with some solved examples :

Your Net home salary is the final amount that you are taking home with you. It is calculated when tax and other deductions are made in the gross salary. Tax amount can be variable for each employee according to the tax slab and you need to find your tax slab according to the guidelines of the government.

Let us see this example. Sanjeev Shetty is a 34-year-old male, who has recently joined his new job at a software company at a CTC of INR 6,11,000. Here’s what the takeaway salary looks like:

| Salary Components | Amount |

| Basic salary | INR 3,00,000 |

| Special Allowance | INR 1,00,000 |

| HRA | INR 50,000 |

| Bonus received | INR 70,000 |

| Total Salary | INR 5,20,000 |

| Less: 12% PF | INR 36,000 |

| Less: Tax Payable | INR 12,875 |

| Take-Home Salary | INR 4,71,125 |

Alternative methods to save taxes

There are a lot of options available for you to make an investment and avail the benefit of tax saving along with the added benefits. Options like mutual funds, FDs, public provident funds, etc can give you numerous benefits. Here are some of the best ways to save taxes in an easy and planned way:

- Make investments in different tools

Under Section 80C of the Income Tax Act of India, if you invest your taxable income into different investment tools then you can claim a deduction of up to INR 1.5 lakhs. The investment tools wherein you can invest and save are:- Employee provident fund (EPF)

- Public provident fund (PPF)

- Tax saver mutual funds (ELSS)

- Tax saver fixed deposits

- National saving certificate (NSC)

- Senior citizen saving scheme

- Sukanya samridhi account

- Save on taxes through a home loan

Paying off your home loans can be a double saver deal for you as you can avail good rebate on the repayment of the principal amount. Under section 80C, if you already have an ongoing home loan, you are eligible to claim for deduction of principal repayment. If you plan for a massive home loan you can claim a tax rebate of up to INR 2 lakhs. - Plan for a tax-saving education loan

Investing in an education loan can make you eligible for complete tax exemption as there are no limits on the deductible amounts. Consulting an expert and investing in a good scheme can give you good monetary benefits. - Saving tax through Leave Travel Allowance

You can claim tax deductions if you are provided with a leave travel allowance by your employer. Keep in mind that you can only avail of this twice in a period of 4 years and the allowance is only available for domestic travel across India.

Salary restructuring

If you can get your salary restructured by your employer and get those allowances accommodated which saves tax for you, then it can be very beneficial for you. Allowances like conveyance allowance, house rent allowance, uniform allowance, medical treatment allowances, internet/telephone allowances, etc. vary from company to company and also from higher rank to lower rank.

FAQ’s

A salary slip is a document that contains the detailed components of an employee’s salary like basic salary, allowances, bonus, tax deductions, employee fund contribution, gratuity, etc. This document is issued to the employee by the employer either on paper or by email.

Net salary is the core of the salary. It is the payment received by the employee before any kind of fringe benefits are added to it. On the other hand, gross salary is the monthly/ annual salary that is paid without any deduction of tax. Gross salary includes allowances, bonuses etc.

CTC, the cost to the company, is the money that is spent by the employer when a new employee is hired. It includes components such as HRA, health insurance, PF etc. Gross salary on the other hand is the salary that is paid to the employee on a monthly/ yearly basis.

Profession tax – This tax is levied by the State government or Government of Union territory in India on all the individuals who are earning by either employment, trade or practising a profession. In India Majority of states like Karnataka, Maharashtra, etc, impose professional tax but states like Haryana and Delhi (UT) do not. Being a subject of the state government, professional tax rates are different across the country. You might need to check your state’s professional tax slab to clear your doubts.

Income Tax – This tax is a direct tax levied by the Government of India on the income of its citizens. This tax applies to salary, income from property, houses, profits from business, and income from other sources. To know the income tax amount to be paid to the government, each individual needs to check the tax slab he falls into.