Human life value cannot be ascertained accurately. However, there are various methods of ascertaining a value in order to understand how much life insurance coverage is needed. This can be effectively done by understanding what is Human Life Value and with the help of a simple calculator.

Human Life Value

Human Life Value is the total amount of money that is needed to provide sustenance to your family in case you happen to die and cannot earn for them. This is just an estimation of the total income that you may generate for your family in your entire lifetime.

Again, there are multiple assumptions in this calculation and there is no fixed rule for the same. However, for the sake of simplicity and estimation of your total life insurance coverage requirement, understanding the Human Life Value is essential.

This can be effectively done by using a Human Life Value Calculator.

Why do you need to calculate your Human Life Value?

The Human Life Value is the total amount of insurance coverage that the insurance companies will provide you. Basically, it is the maximum amount of insurance coverage that you may need based on your income, assets, liabilities, dependents, age, etc.

So, it is a good idea for you to know about the total amount of insurance coverage you should have before you opt for an insurance plan.

Human Life Value Calculator

The Human Life Value Calculator is a treasured tool that helps you gauge all the financial restrictions your family and loved ones would come across in case of your sudden demise. This calculator can help you identify and calculate an estimated protection cover to secure the future of your close ones. The human life value calculator works based on all your liabilities, income expenses, and investments.

The importance of the Human Life Calculator:

The Human Life Value calculator holds extensive importance. Let’s see how!

- Enables in assessing if your existing life insurance coverage is enough

- Assists you to analyze your additional life insurance requirement if any.

- How much money your family would need to sustain themselves in case of your death.

Steps to calculate Human Life Value:

The formula to calculate human life value in insurance is easy. Below is a brief list of steps required to calculate HLV. Follow the procedure to get your HLV.

- Step 1

First, you need to provide your age and your current annualised income along with your monthly expenditure and desired retirement age.

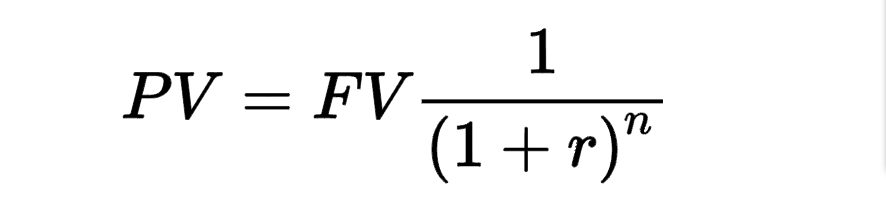

Then the present value of all your future earnings needs to be calculated using the Present Value of PV formula such as:

Where PV is the present value, FV is the total future value, the rate is the rate of return and n is the number of periods. - Step 2:You need to list down your currents assets and liabilities such as:

- Cash

- Fixed deposits

- Mutual Funds

- PPF

- Gold

- Other investments, if any

- Home Loan

- Personal or Car Loan

- Other Loan, if any

- Step 3

Then you need to provide accurate details of all your existing life insurance plans, if any across all insurance providers.

Note: The total sum assured for all life insurance plans need to be mentioned as your “Existing Life Cover” - Step 4

Your total Human Value can be calculated based on the details provided, which is the appropriate coverage for life insurance. So, based on your current life cover, you can opt for the remaining amount of life coverage. - Step 5

Once you know how much additional life insurance you need, you can check the quotes from various insurance companies and choose the plan that best suits your needs.

What is the total amount of life insurance coverage needed?

As mentioned earlier, there is no accurate tool to calculate a human life value, unlike any other non-living product. In General Insurance, the principle of indemnity specifies how much money is needed to replace the exact product. However, in life insurance, the principle of indemnity doesn’t apply. Here, there is a more theoretical approach is needed.

To start this analysis, you need to understand how much money you can earn for your family’s sustenance, dreams and goals and for their current lifestyle. This can be done through various types of life insurance plans including term plans, endowment plans, money back or child insurance plans as well as Unit Linked Insurance Plans. All you need to figure out is the total amount of money your family would need in your absence.

Moving on, if you are wondering how much or what kind of coverage will be enough, the answer is simple. Sufficient insurance coverage will suit al your parameters ideally.

There are multiple ways to calculate Human Life Value such as:

- Need-Based Method:

This method calculates your life insurance requirement and then provides the total coverage that you may need in your entire lifetime based on your current income, lifestyle, dependents, etc. - Income Replacement Method:

This is a more popular method of calculating Human Life Value. It calculates the total amount of money that is needed to replace your current income for your entire life in order to sustain your family. This is usually the method to calculate your Human Life Value for the primary earning member of the family.

In this method, the present value of all your future earnings is taken into account to calculate your Human Life Value.

Factors affecting the quantum of life insurance coverage:

To ensure accurate insurance coverage, you need to consider several factors. Here are some of the factors that you can consider:

- Desired Retirement Age – Current Age

This would provide the total number of years you would be financially supporting your family. So, if you are the primary earning member for your family and providing for their financial requirements, they would still need money to survive even if something were to happen to you. Thus, calculating your total number of productive years wherein you can provide financial aid to your family is your first point of consideration. - Assets and liabilitiesYour current assets and liabilities need to be considered for calculating the human life value.

Assets include your total investments till date, savings as well as real estate and gold investment. Liabilities would include your outstanding loan, credit card repayment, etc. - Monthly ExpensesYou need to include your entire monthly expenses such as rent, food, medication, education, housing, travel, miscellaneous, etc.

- Dreams and goalsHere you need to list down all your future expenses and goals that you have for your family. This would include your aspirations for child education and your retirement as well.

- Current IncomeThis forms the base of the calculation as you need to know how much you would have earned in your entire lifetime.

- Existing Life Insurance CoverageThe existing life insurance coverage amount needs to be subtracted to get your ideal human life value.

It is highly recommended to consider each of these significant aspects.

Conclusion

Preferably, HLV is the monetary value of an individual’s life. Evaluating human life value is highly essential for families that have a sole breadwinner. To sum up, the cover determines the amount of insurance required to suffice both present and future expenses of the policyholder’s dependents in a family.