In India, Aadhaar is a vital document to prove the identity of a person and it is a 12-digit unique identification number issued to the residents of India by the central government. Aadhaar is monitored and issued by UIDAI -Unique Identification Authority of India. Aadhaar is crafted in a way to add certain important information in its database thereby verifying the details of every resident Indian citizen including their name, address, contact number, photo together with their biometric details.

Why is Aadhaar so popular?

Aadhaar card has now become one of the most popular government identity documents for any citizen of India. Your Aadhaar card not only acts as a significant identity proof but also is used in almost all types of services which includes:

- Mostly accepted means of an ID proof

- Essential for verification of SIM card, bank account or Demat account opening

- Necessary for making an investment in a public financial establishment

- Mandatory for taking an LPG gas connection

- Used in MNREGA scheme Mahatma Gandhi National Rural Employment Guarantee Act – A well-designed plan under which the earnings of the employees are directly put into their account

Rationale behind NPS aadhaar link

Other than the above-mentioned areas, there are several service providers where it’s compulsory to provide any Proof of Identity like in booking travel tickets in railways, flight, booking of hotel and many more. And even though there are quite a few alternatives of giving the identity proof, Aadhaar card has become the most necessitated proof of identity due to its capturing of the respective biometric and demographic data for each person thereby reducing the chances of frauds and duplications. The government of India has taken a step to link Aadhaar with various important schemes and other documents and one such scheme is NPS or National Pension Scheme.

What is an NPS or National Pension Scheme?

National Pension System, popularly known as NPS, is a pension scheme and a systematic savings, supported by the Indian Government that lets individuals create a substantial amount of reserve during the time of their retirement. NPS is administered and taken care of by Pension Fund Regulatory and Development Authority -PFRDA, which has recommended its subscribers to do the NPS aadhar link.

The government of India introduced NPS in 2004 mainly to benefit the government employees and the same was expanded for everybody in 2009. A member under NPS has to open a one NPS account wherein he is needed to deposit a minimum of INR 6000 per month.

Aadhaar being an important identity document and NPS being another crucial aspect of an individual’s hard-earned money, Government of India has taken the step to do an aadhaar card link to pension account.

What is the NPS aadhaar link and why is it important?

NPS aadhaar link is a technique in which a person having an NPS scheme can link his or her details of the card to his or her Aadhaar Card. Hence, by doing an NPS aadhaar link, all the details for that individual will be stored in one central repository. And, hence it will be easy to claim the pension when needed without much of documents or hassle. KYC being the most crucial these days to avoid frauds and fake people, by doing an NPS aadhaar link, fulfilling the KYC norms becomes much easier. Hence, it is important to do a NPS aadhaar link.

Let us understand the NPS aadhaar link concept in detail.

How to link aadhaar with a pension account online?

The steps to do an NPS aadhaar link are very simple and easy which you need to follow. Here are the steps mentioned below:

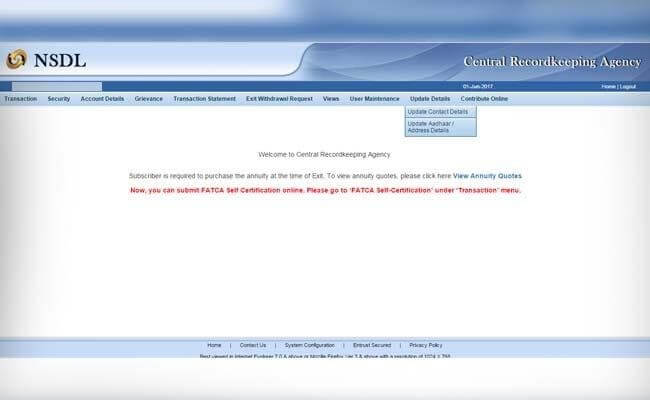

Step 1: Log in to your NPS account by visiting the official website https://cra-nsdl.com/CRA/

Step 2: You will be able to an option of “Update Details”, select “Update Aadhaar/Address Details”

Step 3: Next step for you will select the option of “Add/Update Aadhaar Number”

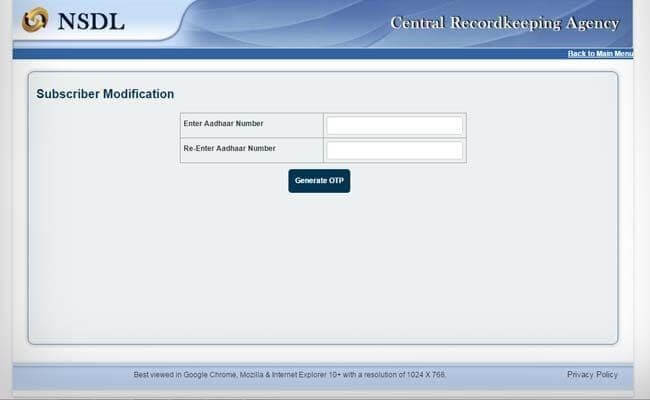

Step 4: Fill in your Aadhaar number carefully

Step 5: Click on the “Generate OTP” key

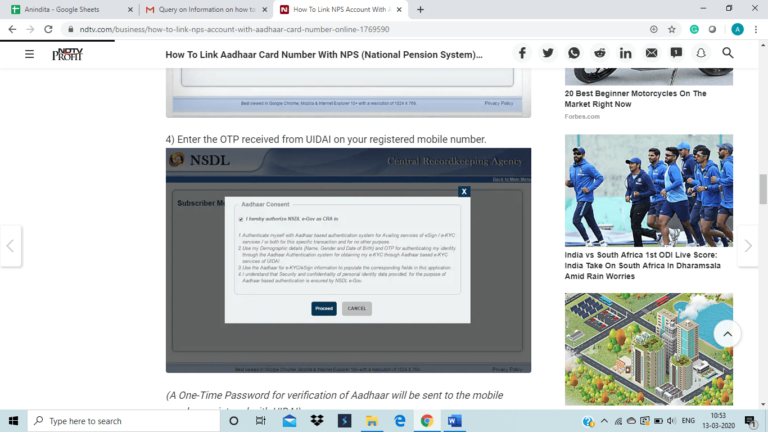

Step 6: Click “Proceed” button to give your permission to NSDL e-Gov to begin the linking procedure

Step 7: An OTP will be sent to your registered mobile number with your Aadhaar records

Step 8: Enter this OTP in the relevant box shown and then click “Continue” button

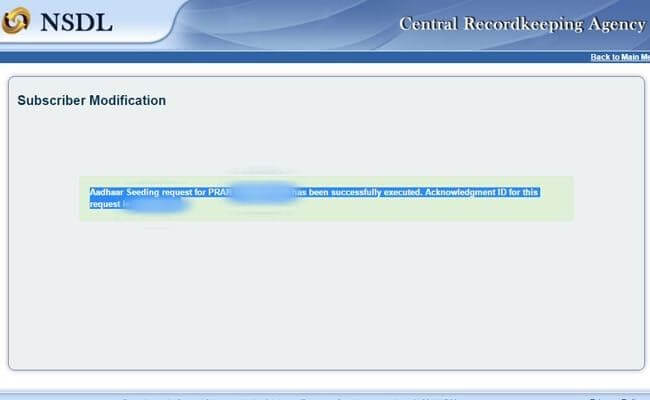

Step 9: After the authentication of the OTP is over, the Permanent Retirement Account Number- PRAN linked to your NPS account that you used to login into your NPS account and the Aadhaar number which you have given will be linked and will show a message as shown below

An important point in which you must note that the name stated by you in PFRDA-Pension Fund Regulatory and Development Authority should match with the name that you have declared in your Aadhaar card.

How to link aadhaar with a pension account online for new subscribers?

It is very easy to open an NPS account online for new subscribers and do NPS aadhaar link during the opening. You need to follow few simple steps as mentioned below and complete the process of NPS aadhaar link

Step 1: Visit the official site of NSDL eNPS portal at enps.nsdl.com/eNPS/NationalPensionSystem.html

Step 2: Click the option of “Registration”

Step 3: Choose the details and fill in your Aadhaar number in the relevant space and click on the “Generate OTP” key

Step 4: Tick on the disclaimer and then, click the “Proceed” button

Step 5: You will receive an OTP to your registered mobile number in your Aadhaar. Now, you need to enter the OTP and click on “Continue”

Step 6: Fill in the NPS registration form carefully, then make the necessary payment. You will receive an acknowledgment number for your request

Step 7: Submit your registration details and generate your PRAN

Step 8: Do an e-sign on the registration form and complete the NPS subscription procedure

Points to remember when doing an NPS aadhaar link

You need to keep in mind certain important points while doing an NPS aadhaar link and the same can be summarized as below:

- The name stated in your Permanent Retirement Account Number or PRAN must match with the name cited in your Aadhaar card

- As a subscriber under NPS, you need to follow the NPS aadhaar link procedure even if you have submitted your Aadhaar during the subscription

- Aadhaar OTP authentication is followed while doing an NPS aadhaar link

- Your mobile number must be registered with your Aadhaar records for you to avail of this facility. Furthermore, it is now compulsory to link your cell number with your Aadhaar

- For the government employees, approval from the respective Nodal officer is a must to do an NPS aadhaar link

Benefits/ Advantages of NPS aadhaar link:

Doing an NPS aadhaar link has many benefits and the same is mentioned below:

- With the support of Aadhaar Authentication process, the opening of an NPS account online has become hassle-free and easy

- You will be able to complete all the KYC standard rules easily for having an Aadhaar

- Government of India has issued guiding principle to all NPS subscribers or its members to link their accounts with Aadhaar in order to track all the financial transactions and provide exemptions to the taxpayers

- Aadhaar OTP guarantees immediate and prompt authentication and by means of an e-KYC through the Aadhaar number helps the subscriber of the unnecessary hassle of any paperwork

There are no major disadvantages as such to do an NPS aadhaar link. Only point is that you need to have a registered cell number to use this facility, and any person who may not have his or her cell number registered, may find this process difficult or rather not possible.

With Aadhaar, you can go ahead and do an NPS aadhaar link effortlessly and without any issue. Make sure you do the same and protect your hard-earned money and get many benefits.

FAQ’s

Yes, it is mandatory. As per the modification in PMLA- Prevention of Money Laundering Act, guidelines by the Indian Government, NPS accounts must be linked with Aadhaar and the deadline was 31st December 2017. Accordingly, all existing members under the NPS are needed to submit their Aadhaar as well as their PAN.

A tax benefit of INR 50000 is permissible over and above the benefit of INR 1.5 Lakhs that may be claimed as a deduction under Section 80CCE of the Income Tax Act, 1961.

Yes, you can. A partial amount to 25% is allowable from the reserve for any crisis situation and retirement.

Below documents are needed to be submitted for opening of an NPS account:

- Duly filled subscriber registration form

- Identity Proof

- Address Proof

- Proof of age and date of birth

No, you will not be allowed to. For one person many NPS accounts are not allowed and there is no need, as the NPS is completely transferrable across segments as well as locations.