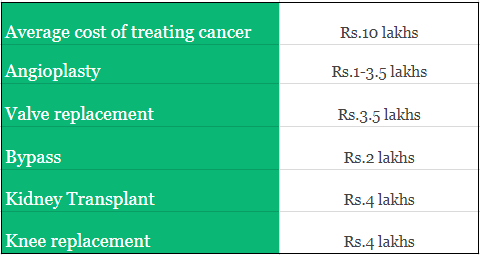

The National Sample Survey Office conducted two surveys on medical incidences and their costs. The first one was conducted in 2004 while the second was in 2014. The results were surprising and disappointing. According to the reports, about 3% out of 1000 Indians faced hospitalization in 2004. The number increased to 4.4% in 2014. Not only did the incidence of hospitalization increase, treatment costs too saw a spike in the decade. The hospitalization cost increased by about 176% for an urban individual. Disappointing, isn’t it? (Source: https://qz.com/663718/charted-the-incredible-rise-in-the-cost-of-healthcare-in-india/ ). Moreover, even the common ailments, nowadays involve huge expenses. See for yourself:

Whew! Can you afford a medical emergency knowing the costs involved?

Given the financial crisis faced in a medical emergency, people buy health insurance plans. But, most of them make a mistake of choosing a low Sum Insured. Is it wise?

Read more about 6 tips to reduce health insurance premiums

The health insurance plan compensates you up to the maximum extent of the Sum Insured you have selected. Thus, it is always recommended to choose a higher Sum Insured in your health insurance plan. If the above medical costs were not reason enough, here are some more for choosing a higher Sum Insured:

You can protect your savings

In life you have various financial goals for which you save. You might save for financing your child’s education, for buying a home or car, for your child’s marriage or for your retirement. If you encounter a medical contingency, you would face huge medical bills. If you have a health plan with a lower Sum Insured you would have to draw upon your savings to pay for the costs not paid by your health plan. In such a situation, not only your goal-planning goes out the window, your savings are drained and you have to start from scratch. Would you want that?

Higher Sum Insured gives sufficient coverage for family members

If you have a family floater plan, having a higher Sum Insured becomes all the more important. Since your family shares the Sum Insured of your health plan, in case of multiple claims in the same year a lower Sum Insured would fall short. If you opt for a higher Sum Insured, you can be assured that your family members would be sufficiently covered under your health plan.

Read more about family floater plan

Is a higher cover affordable?

Though you might understand the importance of having a higher Sum Insured, you might find affordability to be a hindrance. After all, a higher Sum Insured entails a higher premium too. This affordability issue can be resolved if you opt for top-up or super top-up plans.

What is a top-up plan?

A top-up plan is a health insurance plan which increases your Sum Insured without pinching your pockets. Under a top-up plan there is a Sum Insured and a deductible limit. If any health claim exceeds the deductible limit, the top-up plan pays the claim.

For instance, if you buy a top-up plan of Rs.5 lakhs with a deductible limit of Rs.2 lakhs, in case of any claim which is more than Rs.2 lakhs, the top-up plan would be applicable. So, if you incur a claim of Rs.2.5 lakhs, the top-up plan would pay Rs.50, 000.

What is super top-up plan?

Super top-up plan works like a top-up plan. The only difference is while a top-up plan considers each instance of claim against the deductible limit, a super top-up plan aggregates the claims incurred in a year and then matches it against the deductible limit.

For instance, you buy a super top-up plan of Rs.5 lakhs where the deducible is Rs.2 lakhs. If you incur a claim of Rs.1 lakh, nothing would be paid in both top-up and super top-up plans. In the same year, if you incur another claim of Rs.1.5 lakhs, the top-up plan would pay nothing. But, the super top-up plan would pay Rs.50, 000 because the aggregate claims (Rs.1+1.5 lakhs) exceed the deductible of Rs.2 lakhs.

Top-up or super top-up plans can be taken to supplement your coverage level. If you have an existing health plan, choose a top-up or super top-up plan in such a way that the Sum Insured of your existing health plan is equal to the deductible limit of your top-up or super top-up plan. In that case, any claims up to the deductible limit would be paid by your normal health plan and any excess by your supplemental plans.

A higher Sum Insured is necessary in a health insurance plan if you want to combat the high medical costs. So, choose a health plan with an optimal coverage level based on your needs. If affordability is a concern, choose top-up and super top-up plans but don’t shirk on the coverage.Here is why health insurance is necessary.

Read also An anatomy of an health insurance plan

Read more about Dejargonizing health insurance terms

Feel free to share your comments below